Share prices of DraftKings (DKNG -6.84%) have been hitting new highs in 2024 and improving earnings results in the near term point to more new highs, at least according to analysts at Mizuho Securities.

Mizuho initiated coverage of the stock with a “buy” rating and a $58 price target, representing a 24% upside over the next 12 months or so from the stock’s current price. Here’s why the firm is bullish on the shares.

The reason behind the call

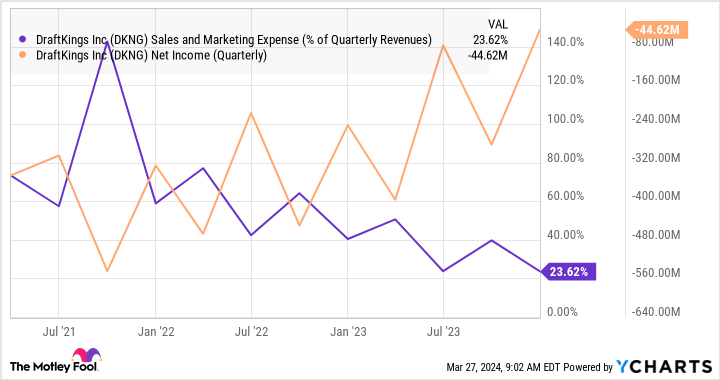

Mizuho likes the company’s commanding lead with over 30% share of the North American online sports betting market. Importantly, this lead allows DraftKings to win new customers without having to increase marketing expenses along with revenue. Marketing is turning out to be a valuable lever to control operating expenses, which should lead to higher profits this year.

In the fourth quarter, the company’s net loss narrowed from $242 million in the year-ago quarter to $44 million. Management is guiding for positive free cash flow between $310 million to $410 million for 2024, which could be even more beneficial for the stock.

Data by YCharts

Is DraftKings stock a buy?

It’s difficult to say when (or if) DraftKings will reach the analyst’s $58 price target.

On the plus side, in addition to lower marketing expenses relative to revenue, DraftKings can also leverage its games and content that is developed in-house, since it can monetize these assets without paying a third party any fees. It seems to have multiple paths to grow more profitable over the long term.

On the negative side, the stock trades at an expensive valuation. However, there’s enough runway in the online gaming and sports betting markets to support new highs for the stock for patient investors. DraftKings management still says it is in the early innings of its growth opportunity.

John Ballard has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.