Is Micron’s AI-driven surge the start of a long-lasting uptrend or a temporary spike? Here’s what’s going on in the memory chip market.

Memory chip maker Micron Technology (MU -0.35%) has a hot hand right now. Micron’s stock is trading near all-time highs, having gained 48% in 2024 and 93% in the last 52 weeks. The current artificial intelligence (AI) boom poured nitro on Micron’s growth fires, boosting this stock chart into the stratosphere. Modern AI systems use a ton of memory and solid-state storage. As a leading supplier of those chips, that’s good news for Micron and its shareholders.

Longtime shareholders can celebrate some game-changing long-term returns. The stock has more than doubled the S&P 500 index’s gains over the last decade. But would this be a good time to start a new position in Micron?

Let’s see how much room there is for further Micron gains at this point.

Are Micron’s growth prospects measured in microns or miles?

There’s plenty of demand for Micron’s products.

Training and operating advanced AI systems requires heavy number-crunching, calling for enormous amounts of short-term DRAM chips. The same systems also need lots of long-term storage with fast read and write performance. The only reasonable choice for this requirement is NAND chips, also known as flash memory or solid-state devices (SSDs).

Micron is not just a leading maker of memory chips, but also an innovator in the space with a performance advantage at the moment. The unchallenged performance per watt of power consumption makes Micron’s latest and greatest high bandwidth memory solution attractive to builders of very large systems, and Nvidia picked this memory type as the standard built-in DRAM in its next-generation AI accelerators.

Unit prices for NAND chips have been stable in 2024 while the average spot price for mass-market DRAM chips is up by 11% year to date. On top of that solid base, sector leader Samsung expects to boost NAND chip prices by 20% over the next quarter and Micron’s technology advantage should allow it to raise prices even faster.

So Micron’s growth prospects look stellar in the near term and I don’t expect the picture to change much over the next few years. Samsung and friends may catch up to Micron’s HBM advantage over time, but that’s a long-term challenge.

Is Micron’s stock fairly valued?

And here’s where things get uncomfortable.

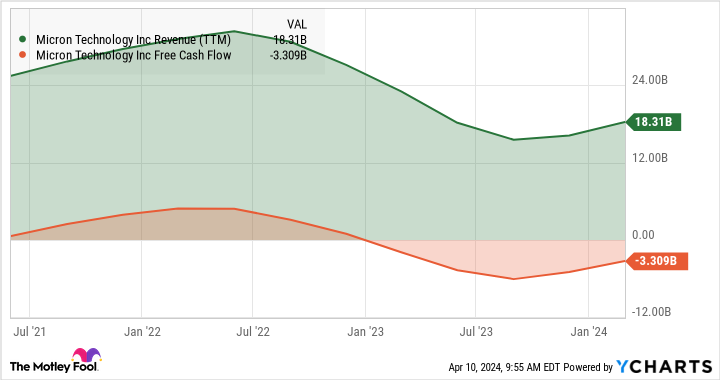

Yes, every market trend points in a bullish direction. Unfortunately, the memory industry bounced off the bottom of a brutal downtrend very recently. As a result, Micron’s trailing sales are down 43% from the summer of 2022 and the free cash flows are deeply negative:

MU Revenue (TTM) data by YCharts

Profit-based valuation metrics don’t make sense when earnings and cash flows are negative, but the always-there price-to-sales ratio stands at levels not seen since the dot-com bubble.

Final verdict: You should probably pick a different AI stock

I’m a longtime Micron shareholder, and the memory industry’s cyclical nature shouldn’t surprise anyone anymore.

But this radical upswing is not like the others. Micron’s valuation makes sense only if you expect structural changes to the memory chip sector as a whole. Specifically, Micron needs to hang on to its technology lead in the long run while the demand for high-end memory solutions continues to skyrocket.

It’s a bit much, even for me.

At this point, I’m seriously thinking about taking some Micron profits off the table to reinvest in lower-priced growth stocks or a stable index-tracking exchange-traded fund (ETF). Your mileage may vary and Micron might have some more rocket fuel in the tank, but I’ll just sleep better at night with a milder exposure to this richly valued stock.

Anders Bylund has positions in Micron Technology and Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.