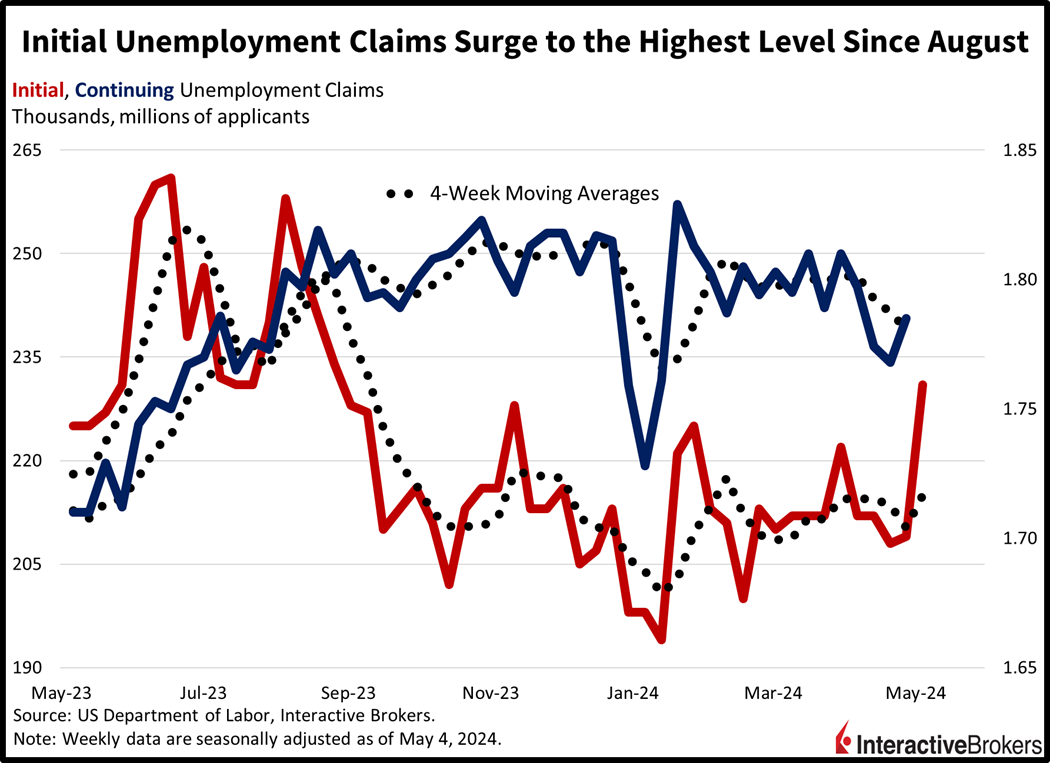

This morning’s news that weekly layoffs rose to their loftiest level since August is sending stocks higher and yields lower. While the absolute level of initial claims currently isn’t concerning, the upward surge in the data warrants caution. A continuation of this pace would certainly lead to elevated unemployment on a relative basis. Investors, meanwhile, are dialing up their rate cut expectations as Fed Chair Powell has consistently stated that softening labor conditions would compel the central bank to ease monetary policy. Adding fuel to the fire is Bank of England Chief Bailey not hesitating to possibly slash the cost of capital prior to an election, as market players hope that the position will serve as a precedent.

Initial Claims Soar Above Expectations

Initial unemployment claims rose to 231,000 during the week ended May 4, battering projections of 214,000 and the previous week’s 209,000. The sharp uptick of 22,000 pushed up the four-week moving average from 210,250 to 215,000. Continuing unemployment claims, however, didn’t shock anyone as they were reported for the week ended April 27. Continuing claims came in at 1.785 million, near estimates of 1.79 million and the prior week’s 1.768 million. They’re indeed trending lower, with the indicator’s four-week moving average declining from 1.787 million to 1.781 million.

Travel and Digital Advertising Continue to Grow

Travel trends appear to be moderating but are still strong while digital advertising is continuing to grow rapidly. In another development, artificial intelligence has helped chip designer Arm generate strong first-quarter results, although the company’s guidance disappointed investors. Those are a few highlights from the following earnings discussions:

- Airbnb shares declined approximately 8% after the company said it anticipates that second-quarter revenue will range between $2.68 billion and $2.74 billion. Only the higher number met analysts’ estimates. Revenue will be challenged by currency exchange rates and this year’s early occurrence of Easter, which caused an increase in first-quarter travel that otherwise would have occurred in the current quarter. Chief Financial Officer Ellie Mertz told analysts that Airbnb seeks to generate high earnings growth rather than the stable growth provided by its guidance. Based on quarter-to-date trends, however, Airbnb believes its weaker-than-expected outlook is appropriate. The company believes growth will accelerate in the third quarter due to special events such as the Paris Olympics. In the first quarter, US booking growth decelerated, but it accelerated in Asia-Pacific and Latin America. For the quarter, earnings exceeded the analyst consensus expectation.

- Warner Bros. Discovery’s first-quarter earnings and revenue missed analyst consensus expectations due to TV advertising and studio operations producing disappointing results. The secular trend of consumers and marketers preferring streaming entertainment is continuing with the company reporting that subscribers to its Max service grew significantly and advertising revenue climbed 70% while its cable TV and film studio produced disappointing results. Additionally, its video game “Suicide Squad: Kill the Justice League” produced lower-than-expected revenue.

- The Trade Desk also reported strong advertising revenue for connected TV and posted first-quarter earnings and revenue that beat analyst expectations. The Trade Desk provides ad placement within digital media and has recently been growing its revenue through streaming entertainment. In the first quarter, revenue climbed to $491 million from $383 million, significantly surpassing expectations. In announcing its results, the company said it has expanded its relationship with Walt Disney’s streaming service and that Comcast’s NBCUniversal will tap the company’s platform for Olympic ads. The company’s share price climbed 2% yesterday following the earnings report.

- Arm, which licenses designs for computer chips, issued full fiscal-year guidance ranges for revenue and earnings with midpoints that only met analyst expectations, causing its share price to decline 7% this morning. However, its recent-quarter earnings and revenue surpassed analyst consensus expectations with sales driven by demand for artificial intelligence chips and smartphones. For the quarter, it generated net income of $224 million while the company only broke even in the year-ago quarter.

Risk Assets Rally on Increasing Optimism for Fed Easing

Markets are aiming for the North Pole today and continuing a multi-day rally with the Dow Jones Industrial index seeking its seventh-consecutive daily gain. Investors perceive labor market softening as a green light for more liquidity from the Federal Reserve. All major US equity indices are trading higher with the rate-sensitive, small-cap Russell 2000 leading the charge; it’s up 0.6%. The Dow Jones Industrial, S&P 500 and Nasdaq Composite benchmarks are not far behind, gaining 0.5%, 0.4% and 0.3%. Sector breadth is terrific with all eleven segments gaining on the session. Real estate, energy and industrials are running ahead of the pack, sporting increases of 1.8%, 0.9% and 0.8%. Treasury yields are moving south alongside the dollar, despite yesterday’s lackluster 10-year note auction. The results of this afternoon’s offering of 30-year bonds amounting to $25 billion may influence the market later today. For now, however, the 2- and 10-year Treasury maturities are trading at 4.82% and 4.48%, 2 basis points lower so far on each. The Dollar Index is down 18 bps while it changes hands at 105.31 as lighter rates, softening economic prospects and an incrementally accommodative central bank weigh upon its exchange rate. The greenback is losing relative to its major contemporaries ex-Asia, including the euro, pound sterling, franc and Aussie and Canadian dollars. It is strengthening relative to the yen and yuan, however. Crude oil is moving south as traders contemplate cooler demand prospects stateside against the backdrop of Beijing increasing its imports of the commodity. WTI crude is trading at $79.04, a decline of 0.2%, or $0.14 per barrel. Copper is moving higher by 0.6% as the potential for lighter monetary policy would favor the capital-intensive manufacturing sector. However, gold, a critical indicator of defensive positioning, is also moving higher, signaling the possibility for a reversal in risk assets as traders may lack conviction.

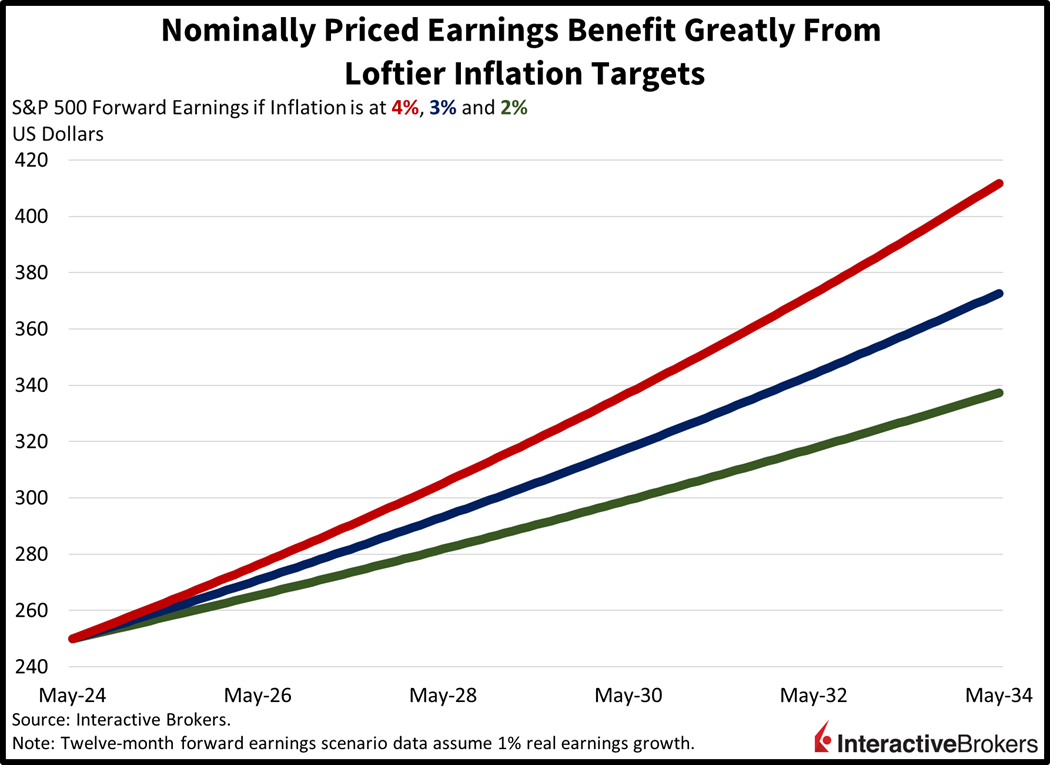

Synchronized Easing Hatches Inflation Put

The sharp increase in unemployment office lines follows the weakest jobs report of the year. Against the backdrop, Bank of England Chief Andrew Bailey remarked that lowering rates before this year’s election wouldn’t be an issue. Investors are optimistic that Bailey’s perspective will be adopted by Powell, as global central banks appear ready to embark on a synchronized monetary policy easing cycle. Similar to the Fed, there was no appetite to hike at this morning’s meeting in London, with two out of nine voting members calling for a cut. The rush for interest rate reductions across the globe occurs as inflationary pressures remain well above targets. The inflation put has indeed been born ladies and gentlemen, relieving corporations of the sacrifices required for the 2% inflation objective. Patient central banks that implicitly accept inflation at around 3% to 3.5% drive nominally priced assets, like stocks, to loftier levels. After all, earnings per share will be supported by yet another stabilizing force.

Visit Traders’ Academy to Learn More About Unemployment Claims and Other Economic Indicators

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.