Carl Icahn is one of the top activist investors in the world. Icahn is a legend in the investing world for his ability to identify undervalued companies and push for changes in management or strategy that can help make those companies more valuable.

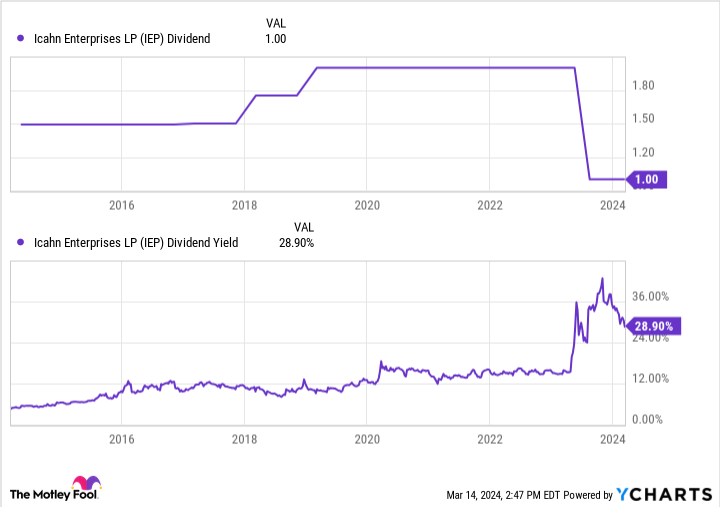

Icahn has 57% of his investment portfolio invested in a single stock: Icahn Enterprises (IEP 0.75%). The stock offers an impressive dividend yield nearing 29% but has faced significant scrutiny over the past year. As a result, its price has fallen 66% since May 2023. Although Icahn Enterprises offers an appealing dividend, there are some things you’ll want to consider before buying the stock.

Carl Icahn’s investing approach

Carl Icahn has an impressive history of investing success. Icahn takes a value approach, much like Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett does. However, their investment styles do have some significant differences.

Buffett tends to take a hands-off approach in the stocks Berkshire buys a share of, allowing management teams to operate independently without his interference or constant monitoring. Because Buffett and his team at Berkshire take a long-term view of stocks, they invest in management teams they trust can run the business smoothly.

On the other hand, Icahn takes an active role in shaking up management teams and working to institute other changes he believes will turn around the business. Icahn was one of the first activist shareholders, earning him the nickname “corporate raider.” One of his more recent successes was in 2014, when he purchased eBay and encouraged it to spin off PayPal, which had stellar returns in the years that followed.

Evaluating Icahn Enterprises’ business performance

Icahn does most of his activist investing activity within the investment segment of Icahn Enterprises. There, he seeks out undervalued companies and looks to improve their valuations by cutting costs or making strategic acquisitions that could help make the company more efficient.

Through the end of last year, investments in this segment were valued at $3.2 billion and included both long and short positions. Some of its holdings include Crown Holdings, Southwest Gas Holdings, Illumina, and Bausch Health Companies. Icahn’s investing segment struggled mightily over the past five years, losing $2.3 billion.

One reason for its struggling investment performance was Icahn’s short-selling activities. Over the past several years, Icahn has taken significant short positions, including credit default swaps (CDSs) that he used to short commercial mortgage-backed securities.

Icahn said in a 2023 letter to unitholders that his team had “strayed over the past several years from our activist methodology and shorted (hedged) far more than was necessary.” He went on to say, “Going forward, we intend to stick to our knitting and focus on our activist strategy while remaining appropriately hedged.”

Image source: Getty Images.

In addition to investing, Icahn Enterprises holds controlling interest in several companies in the energy, automotive, food packaging, and real estate sectors. Its largest holding is CVR Energy, where it owns 66% of the company’s outstanding stock. CVR Energy is primarily engaged in petroleum refining and marketing, along with nitrogen fertilizer manufacturing, and has been one of the better holdings for Icahn Enterprises over the years.

Icahn stock has become a target of short-sellers

Icahn Enterprises has fallen significantly over the past year. One of the primary causes was the report from the famed short-seller Hindenberg Research. According to the report, Hindenberg alleged that Icahn Enterprises’ net asset value was overstated.

Hindenberg went on to say that Icahn Enterprises traded at a 218% premium to its net asset value (NAV) at the time, primarily due to retail investors attracted to its high dividend payout and the opportunity to invest in the legendary activist investor and alleged that the company didn’t have enough cash flow to support its distribution.

IEP Dividend data by YCharts

Is Icahn Enterprises stock a buy?

Icahn Enterprises offers a juicy dividend yield that could entice income-focused investors. Carl Icahn says the company is returning to its activist investor roots, which should help improve its investment performance, which has been a drag on the business for years.

However, the company has its work cut out for it, as its debt-to-equity ratio rose significantly last year, and its dividend is vulnerable to further cuts. Therefore I would avoid buying the stock today.

Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway and PayPal. The Motley Fool recommends Bausch Health Companies, Illumina, and eBay and recommends the following options: short July 2024 $52.50 calls on eBay and short March 2024 $67.50 calls on PayPal. The Motley Fool has a disclosure policy.