By Ryan Gorman, CFA, CMT, BFA

1/ Watching the Russell

2/ Transports Not in Gear

3/ A Longer Look at Breadth

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

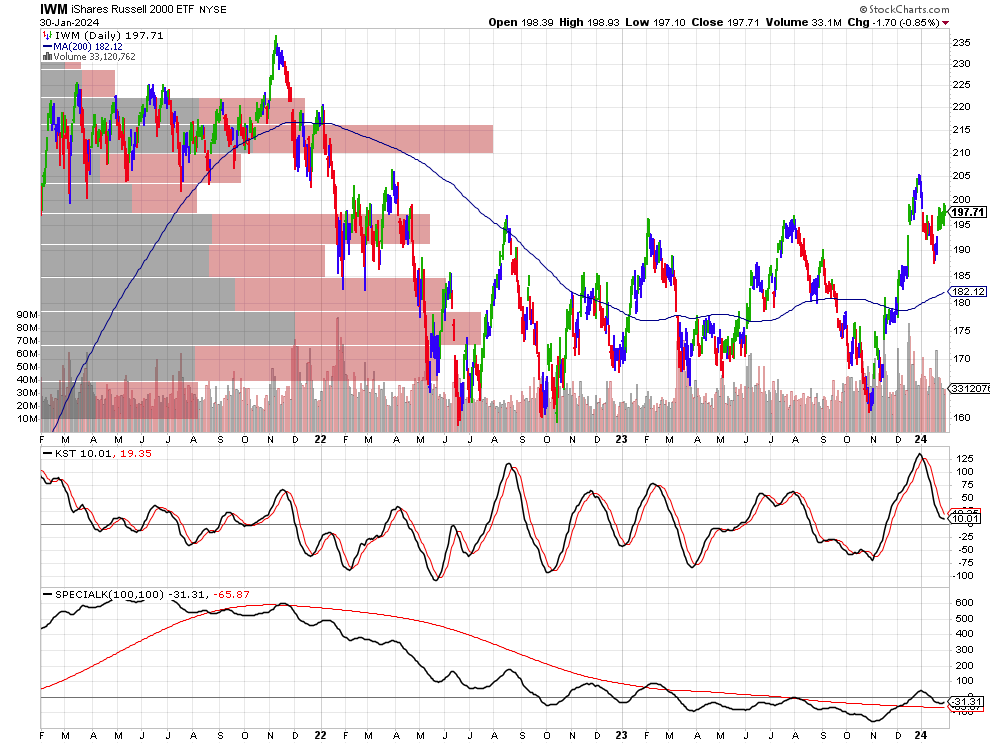

1/ Watching the Russell

The clear leaders in the last year and even in 2021 was U.S. Large cap stocks. Namely Large cap tech. Today we are looking at a few charts that may be suggesting caution for the larger market itself. It is always worthwhile to do analysis of the specific stocks you wish to trade, but I also like to look at the bigger picture.

The Russell is at the top of its recent yearlong trading range which is just below a yearlong trading range in 2021. It is said the Russell 2000 is more economically sensitive due to the constituents being smaller non-global companies. Further it is estimated that around 40% of these firms are not profitable.

Many economists predicted a recession in 2023 that did not materialize. It is worth pointing out that this index is nowhere near its all-time high like other indices. In fact, according to sentiment trader, the Russell 2000 was recently 20% from its high while the S&P 500 was hitting a high. This has never happened before.

The good news? Elder impulse bars are green and the 200-day moving average is turning up. If the market broadens out here, this would be a bullish sign!

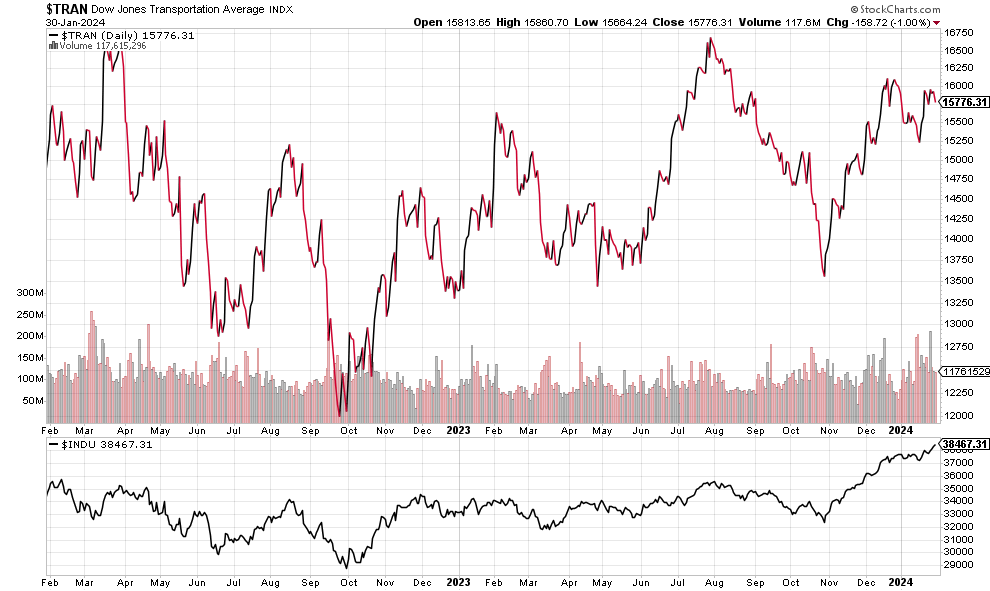

2/ Transports Not in Gear

Keeping in theme, another index that has not made a new high and is in fact making a few lower highs is the Dow Transportation index. When Charles Dow created the indices, Dow Jones Industrial Average, Dow Jones Utilities and Dow Jones Transportation index, he used them for effect forecasting of the economy. The idea was that if the industrials were producing goods but there was not confirmation from the transportations showing they were being shipped, the economy was weakening. It is the idea of confirmation or rule of the majority that we are highlighting today.

Near term, resistance is around the December high. Getting through that would still require another 750 points or so to hit highs. It would be a good step to participate and take out the December and August 2023 highs.

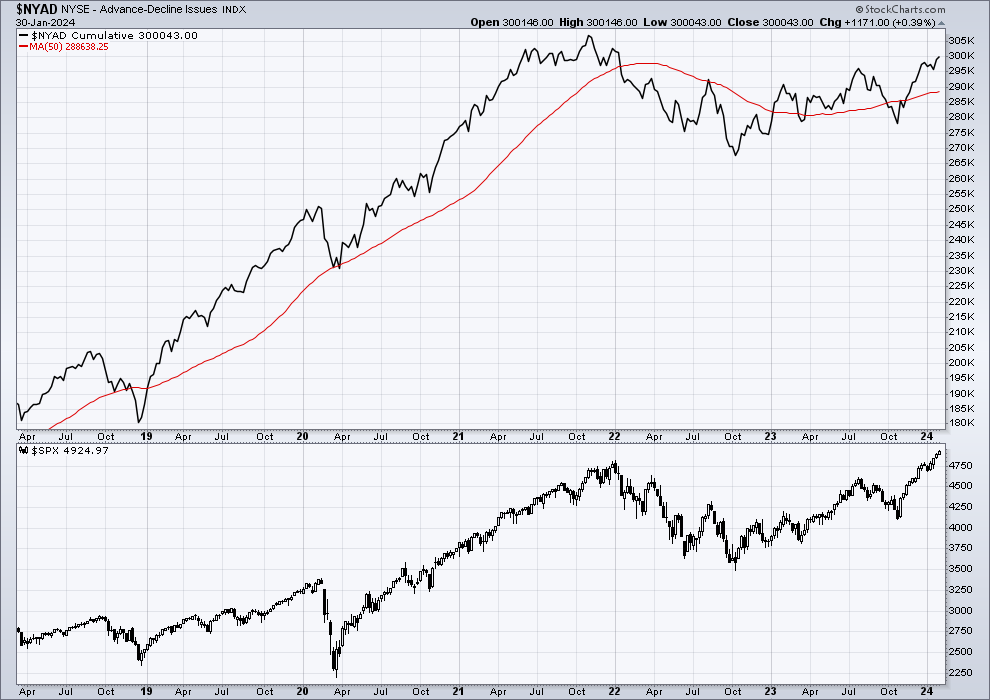

3/ A Longer Term Look at Breadth

Legendary market analyst Bob Farrell has 10 rules for investing, you can read them all here: Bob Farrell’s 10 Rules [ChartSchool] (stockcharts.com)

I am interested in number 7. “Markets are strongest when they are broad and weakest when they are narrow to a handful of blue chip names”.

There has been a lot of talk about the impact of the Magnificent 7 stocks (Apple, Microsoft, Google, Amazon, Meta and Tesla) on the returns of the broad indexes. It is obvious more than 7 stocks have gone up. I have come to view the market like a frozen lake (I am in Michigan afterall). Trend tells us if there is ice or not. This is key if we want to engage in market activities, but breadth tells us how thick the ice is. Thin ice does not mean you will fall through, nor do we have any idea when it could occur, but it does tell us the risk of falling through is higher.

Zooming out on a weekly basis, we can see that the S&P 500 has taken out the January 2022 high, but the advance decline line has not. This likely reflects the Russell 2000 and Dow Transport’s weakness discussed above. In November and December, a lot of work was done to improve this, should the market correct and continue to improve, that would be a very favorable sign!

—

Originally posted 31st January 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.