Louis looks for rate cuts in the spring… why he and Luke Lango are bullish about the pushback… will Powell sounds dovish again tomorrow? … the risk of “irrational exuberance”

Legendary investor Louis Navellier just pushed back his timeline for rate cuts – and to avoid misinterpretation, this is a good thing.

Back in early-December, Louis was eyeing January or February for when the Federal Reserve would enact its first rate cut. Behind the forecast was crashing inflation.

From Louis, the first week in December:

Inflation continues to cool – and it’s growing more likely that the Fed will cut rates in the New Year.

They won’t cut rates in December, but it looks like they will be cutting rates in January or February. We just have to give them the data to do so.

Since then, inflation has continued dropping which suggests the Fed has the data Louis referenced. So, what’s behind Louis’ new forecast for rate-cut timing? And when does he see it happening?

Let’s jump to Louis’ latest issue of Growth Investor:

A series of key interest rate cuts by the Federal Reserve is also expected to fuel a big stock market rally right up to the November presidential election. The big question, though, is when will these rate cuts commence?

Considering that December retail sales rose 0.6% and Treasury yields then meandered higher, some economists don’t anticipate rate cuts until April.

The fact is December’s retail sales were the strongest in the past three months and significantly better than economists’ expectations.

In other words, the economic data has been too good and employment data has also been favorable, so I suspect the Fed won’t cut rates until April, too.

Bottom line: The data suggest we just don’t need rate cuts due to the strength of the economy. And while this requires some shorter-term recalibrating on Wall Street, it’s bullish from a longer-term perspective.

Our hypergrowth expert Luke Lango made this point a week ago

In Luke’s issue of AI Trader last Tuesday, he highlighted the encouraging consumer sentiment report from the University of Michigan, and the Conference Board’s leading economic indicators index showing significant improvement in December.

Here’s his takeaway:

The U.S. economy is turning a corner right now.

The data broadly underscores that the economy is both strong and non-inflationary – a perfect “Goldilocks” environment.

Meanwhile, something else very interesting has happened – the odds of a March rate cut have dropped all the way to 40%, and rate-cut expectations have plunged.

This means Wall Street is realizing that the U.S. economy is actually quite strong, and rate cuts won’t be necessary as a Band-Aid. This is very bullish.

We don’t want an economy that is weak and desperately needs rate cuts. We want one that is strong and could grow even stronger with rate cuts.

That is a durable economic foundation upon which a multi-year bull market can thrive.

This doesn’t mean the stock market is 100% out of the woods

Remember, there’s the state of the economy, and then there’s how Wall Street is pricing stocks relative to its assessment of the state of the economy.

Louis’ favorite economist Ed Yardeni is concerned about the market mispricing stocks based on the Fed, leading to a bursting bubble. This ties back to the “recalibrating” from Wall Street that I mentioned a moment ago.

Let’s jump to CNBC for more:

The Federal Reserve is risking a dotcom bubble-like market problem unless it lowers Wall Street’s expectations for interest rate cuts, widely followed market strategist Ed Yardeni said…

Yardeni is worried that aggressive Fed easing “risks fueling irrational exuberance,” a term that former Fed Chair Alan Greenspan coined in 1996 for the runup in stock prices ahead of the dotcom bubble bursting.

“Over the years, we’ve learned that recessions can be caused by bursting speculative bubbles,” the analyst wrote in his daily market briefing Monday.

“If Powell and his colleagues take a victory lap and celebrate their success at bringing down price inflation without causing a recession by lowering interest rates, they run the risk of fueling asset inflation. When that bubble bursts, a recession most likely would ensue.”

This puts tomorrow’s press conference with Powell in the spotlight.

If it’s not on your radar, the Federal Reserve concludes its January policy meeting tomorrow, after which we’ll hear from Fed Chair Powell

To Yardeni’s point, Wall Street will be laser-focused on Powell’s comments and tone when he speaks about rate cuts. And if we want to avoid a bubble, Powell needs to rein in bullish expectations far better than he did during his press conference a month ago.

You may recall that in Powell’s Q&A session after the Fed’s December meeting, Nick Timiraos from The Wall Street Journal pointed out that the market was pricing in a September Fed Funds rate that was a full point below current levels, with cuts beginning in March.

He asked Powell “Is this something you are broadly comfortable with?”

It was a perfect opportunity for Powell to talk down the market/Fed misalignment. Instead, the Fed Chair mush-mouthed his way through a reply that did nothing to tamp down bullish hopes:

So, this last year has been remarkable for the sort of seesaw thing back and forth we’ve had over the course of the year of markets moving away and moving back and that kind of thing.

So, and what I would just say is that we focus on what we have to do and how we need to use our tools to achieve our goals, and that’s what we really focus on.

And people are going to have different forecasts about the economy, and they’re going to — those are going to show up in market conditions, or they won’t, you know, but in any case, we have to do what we think is right.

And, you know, in the long run, it’s important that financial conditions become aligned or are aligned with what we’re trying to accomplish, and in the long run they will be, of course, because we will do what it takes to get to our goals.

And ultimately that will mean that financial conditions will come along. But in the meantime, there can be back and forth, and you know, I’m just focused on what’s the right thing for us to do, and my colleagues are focused on that too.

If this version of Powell shows up tomorrow, there’s a far greater risk that bulls feel emboldened, leading to the inflating asset bubble that Yardeni fears. We’ll be listening closely and will report back in tomorrow’s Digest.

Finally, let’s do a quick earnings check-in before we wrap up

As of last Friday, 25% of the S&P had reported Q4 earnings.

For how they’re shaping up, let’s turn to FactSet, which is the go-to earnings data analytics group used by the pros:

For Q4 2023, the blended (year-over-year) earnings decline for the S&P 500 is -1.4%.

If -1.4% is the actual decline for the quarter, it will mark the fourth time in the past five quarters that the index has reported a year-over-year decline in earnings.

At this stage of the fourth quarter earnings season, the overall performance of the S&P 500 continues to be subpar.

The percentage of S&P 500 companies reporting positive earnings surprises is below average, while companies are reporting actual earnings that are below estimates in aggregate.

Now, this earnings season will certainly lead to some shorter-term volatility, but the more influential factor on your portfolio is where earnings go in 2024. FactSet pegs the S&P’s 2024 full-year earnings growth at 11.6%.

We’ve been skeptical of this forecast here in the Digest based on evidence the economy is slowing (though in a way consistent with a soft landing, at least for the moment).

But even if that 11.6% growth figure plays out, the potential danger is how richly Wall Street is pricing itself today relative to tomorrow’s unknowns. And per usual, it appears Wall Street is getting ahead of itself.

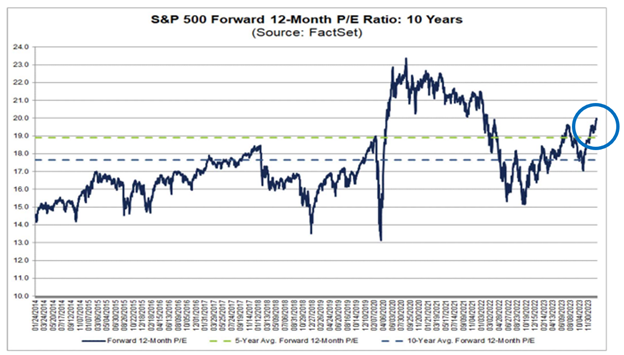

Below, we look at the S&P’s forward 12-month price-to-earnings ratio (PE). This measures how expensive stocks are today compared to analysts’ estimates of where earnings will come in over the next 12 months.

The dotted blue line represents the S&P’s 10-year average forward PE value. The dotted green line represents the average 5-year forward PE value.

As you can see, Wall Street is pushing today’s forward PE value above both averages. Dating back to 2014, we’re on the high side of where valuations have measured.

And keep in mind, this is based on analysts’ guesses about where earnings will come in. History shows that analysts repeatedly overestimate earnings. In other words, we’re likely even more richly valued than this chart shows.

If we want to prevent this line from exploding higher as part of the “irrational exuberance” bubble that Yardeni wants to avoid, we need Powell to sound measured tomorrow.

Recent history suggests that might not be the case.

We’ll update you tomorrow.

Have a good evening,

Jeff Remsburg