Investors have been excited about the S&P 500 reaching a new high, but the hope is that it will go much, much higher. That will take time, and the goal in investing is long-term compounding. However, if economic trends continue to be favorable this year, the market could end 2024 on another high.

In the short term, investors are waiting for more positive news from companies they watch. SoFi Technologies (SOFI -0.39%) had a knockout 2023, closing out the year with a 116% gain. As January wraps up, SoFi stock could soar.

Why is SoFi so popular?

SoFi is an all-digital financial services platform that started as a student loan cooperative. Having that as its baseline has helped it expand with the young and beginner customer in mind, and people love its easy-to-use interface that cuts out many of the pain points of managing their financial activities.

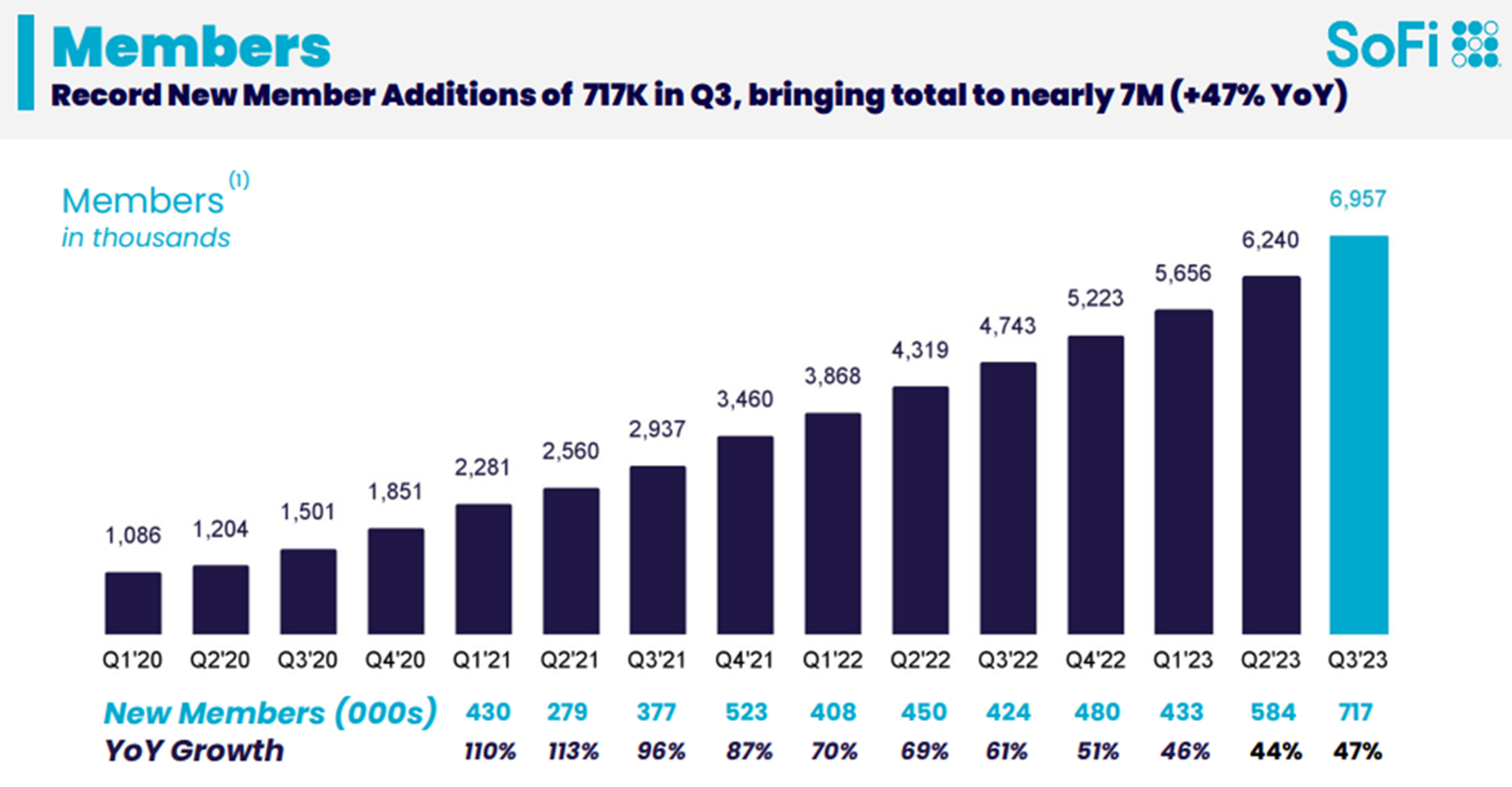

The company continues to onboard new members at a rapid pace, and that accelerated in the 2023 third quarter to 717,000 new members and more than 1 million new products adopted.

Image source: SoFi.

High interest rates can affect banks with higher default rates and increased provisions for losses, as well as lower loan origination. But it can also affect them positively with higher net interest margins. For small digital banks like SoFi, challenging economic conditions provide the opportunity to attract new customers who might be fishing for better rates and an upgraded experience. SoFi is managing to reach new cohorts and generate higher margins, but its lending segment is performing well right now also.

The student loan business, which was severely affected by the loan moratorium, is benefiting from a return to loan payments, and from borrowers converting their loans to new providers with better terms. Student loan origination more than doubled in Q3 year over year.

SoFi got a bank charter in 2022 when it acquired Golden Pacific Bancorp, and that was a turning point for its trajectory. Instead of being just a lender, SoFi is now a full financial services company with a diversified business. There are two main reasons that’s so important for SoFi. One is the new exposure to benefit from all sorts of products and services with more sales. The second is the way all these segments work together to grow the business without adding high costs.

Management calls this its financial services productivity loop, and it’s leading to scale and improved profits. All of SoFi’s three segments — lending, technology platform, and financial services — reported positive contribution profits for the first time in Q3.

The best is yet to come

SoFi is still a young company figuring out its way forward and benefiting from high growth. Revenue increased 27% year over year in Q3, and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) was up 121% to $98 million. Its growth strategy is working, and the growth runway is long.

SoFi has yet to report a net profit, but management is guiding for positive net income in the 2023 fourth quarter. It has reiterated that guidance several times. But as it gets closer to the Q4 results, SoFi stock has tanked in 2024, down 23%. That’s mostly due to an analyst downgrade, but it’s not unusual for a stock that has climbed up to fall prior to an earnings report.

SoFi is due to report Q4 earnings on Monday, and if it demonstrates high revenue growth and comes through on its profit, expect its stock to jump. However, don’t buy SoFi stock for that reason alone. SoFi is executing a great business model and capturing market share. It has incredible long-term potential, and it could be a top growth stock in 2024.