January’s payrolls report shows 353,000 jobs … wage growth accelerates … the biotech sector is on fire … will you play it for short- or long-term gains? … how Luke Lango and Eric Fry view it

No recession in sight.

That’s the takeaway from this morning’s nonfarm payrolls report.

It showed the U.S. economy added 353,000 jobs in January, destroying the Dow Jones estimate for 185,000.

Similarly, the increase in average hourly earnings towered above estimates. It came in at 0.6% on the month, double what economists expected. On a year-over-year basis, wages popped 4.5%, which was above the 4.1% forecast.

In a normal world, this would be considered good news – after all, these data reflect a thriving, robust economy.

But in today’s upside-down world, traders are less enthused by this strength because it means the Federal Reserve will feel less urgency to cut rates. Plus, at whatever point the Fed does cut rates, the scope of those cuts is more likely to underwhelm Wall Street hopes.

This perspective results in headlines such as the one from CNBC this morning:

S&P 500 rises after strong tech earnings, gains kept in check following jobs report

Talk about “wrong priorities.”

I find it backwards that some traders would prefer a weak economy to facilitate rate cuts instead of a robust economy to support longer-term earnings growth.

The focus on cuts feels like a vote for faster-yet-flimsier market profits instead of slower-yet-more-robust/sustainable market gains. But Wall Street loves its fast profits.

It will be interesting to see what the various Fed presidents have to say about this jobs report in the coming days. We’ll keep you updated.

Speaking of “fast profits,” the biotech sector is printing money right now

To illustrate, let’s look at recent profit-taking in Luke Lango’s biotech-focused trading service, High Velocity Stocks (members can log in here).

For newer Digest readers, High Velocity Stocks is the sister trading service to AI Trader. Both focus on momentum stocks that are rooted in a “stage analysis” market framework. I’ll explain this approach in greater detail later; first, the recent profits.

- On December 21st, Luke’s subscribers pocketed 30% gains from Autolus Therapeutics (AUTL) – in just under one week.

- On January 4th, they locked in ~40% profits in Amneal Pharmaceuticals (AMRX).

- On the 8th, it was a 100% winner from Ardelyx (ARDX) in just five months.

- On the 29th, ADC Therapeutics (ADCT) provided ~56% returns.

- And this past Wednesday, subscribers sold a second tranche of their ADCT position for 75% profits.

A much-deserved “congratulations” to all the High Velocity Stocks subscribers on these winners.

Stepping back, what’s happening here? And is it too late to trade the biotech sector?

No – in fact, Luke believes that the most spectacular fireworks remain in our future.

From Luke’s High Velocity Stocks issue from Wednesday:

We’re in the midst of a 2024 Biotech Boom.

And since rates should keep moving lower, we think this boom will last all year.

The market tides continue to turn in favor of biotech stocks as investors grow increasingly confident in a soft landing for the U.S. economy in 2024 and risk sentiments are meaningfully improving.

Biotech stocks will keep surging. And we will keep raking in the profits by buying the best breakouts in biotech.

Biotech is a winner whether we analyze it fundamentally or technically

As Luke just pointed out, the prospect of lower interest rates will be an enormous tailwind for the biotech sector in 2024.

Biotech R&D can be enormously expensive, often funded through debt. So, as interest rates fall, that has a direct impact on bottom lines, helping expand profit margins.

And yes, today’s jobs report could slow the timing of the first rate cut, but Federal Reserve Chairman Jerome Powell did explicitly say in his press conference on Wednesday that the Fed members do, in fact, see cuts coming later this year.

But there’s another reason why biotechs are surging today…

Artificial intelligence.

Let’s turn to our macro expert and editor behind Investment Report, Eric Fry, for more:

Artificial intelligence has come to change biotech’s game in unfathomable ways.

Namely, AI could revolutionize the economics of drug discovery.

First, it could boost the success rates of new therapies by pre-qualifying potential drug candidates more expertly than traditional trial-and-error processes could.

Second, it could reduce the average expense and timeline of advancing these candidates through clinical trials by shortening the drug-development timeframe.

To illustrate, Eric walks readers through a hypothetical.

Imagine that AI eliminated 25% of flawed potential drug candidates before they ever entered clinical trials. That alone would slash the average cost of drug development from $2.6 billion to about $2 billion.

Next, say that AI-centric analytical processes could reduce the drug-development timeline by 25%. That could shave another 25% off drug development costs, lowering the average cost to less than $1.5 billion.

Here’s Eric’s takeaway:

In other words, the all-in average cost of drug development could drop more than $1 billion.

If the pharmaceutical industry could save $1 billion here and $1 billion there, eventually it would be saving real money.

But this hypothetical is based on projected cost savings – so, why is biotech surging today?

Here’s an answer you might not see coming…

Who cares?

Knowing “why?” a stock or sector is surging is great, but having that information is unnecessary and irrelevant when it comes to profiting from such a surge.

This is the core principle behind the stage analysis framework underpinning Luke’s trading services.

If you’re new to stage analysis, its focus is the one thing that matters to your portfolio value: the price action of a stock, and whether it’s headed in the direction you want with robust momentum.

When you boil it down, any given point in time, a stock is either trending up, down, or sideways. This means there are four unique stages for a stock: 1) going sideways at a bottom, 2) going up, 3) going sideways at a top, or 4) going down.

Stage analysis is the science behind figuring out which of these four stages a stock is in at any given point in time and either investing…or steering clear.

The key to scoring big returns consistently is to find stocks on the cusp of entering Stage 2 – or stocks that are already breaking out.

From this perspective, why a stock is in any given stage isn’t all that important. The only thing that matters is whether you correctly identified a Stage-2 breakout.

To illustrate, imagine that Biotech #1 was losing customers, losing market share, and hemorrhaging cash – yet its stock price was surging. And despite your analysis, you couldn’t figure out why.

Would you prefer to stay on the sidelines because of Biotech #1’s fundamental warts and your inability to explain the jump in price?

Or would you rather take the trade based purely on its exploding price, and ride the momentum higher for as long as it runs?

If your goal is making money, then the answer is obvious.

The entire biotech sector appears poised for a massive breakout

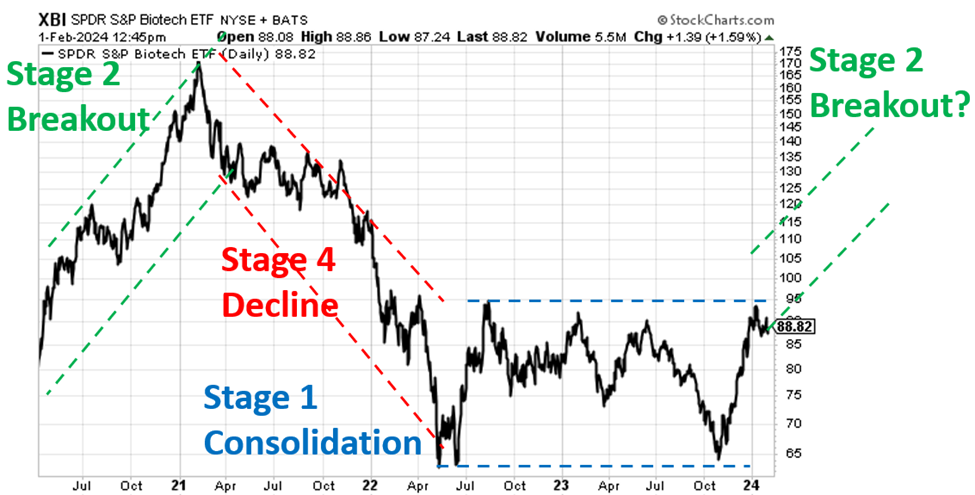

Scroll back up and look at the stage analysis graphic once more.

With this as our guide, where is the biotech sector today?

As you’re about to see, it’s on the cusp of a breakout into Stage 2 – and if it does, Luke is right about the biggest fireworks being in our future.

To be clear, the gains that Luke’s subscribers have enjoyed in recent months have been part of the sector’s Stage-1 consolidation. But an official Stage-2 breakout hasn’t even begun.

Below, we illustrate this using XBI, which is the SPDR S&P Biotech ETF. We’re going back to 2020 to get a 30,000-foot perspective on where we are in the stage analysis cycle.

As you can see, XBI is running into the resistance line of its Stage-1 consolidation channel.

If it breaks through resistance on heavy volume, that suggests a Stage-2 surge is right around the corner.

But what if the biotech sector turns south and remains in Stage 1?

That’s a possibility.

If XBI gets rejected at the top of its Stage-1 channel, the sector will likely pullback – potentially sharply. Investors must be aware of this risk.

This is why Luke urges biotech traders to use stop losses and wise position sizes. It’s also why he’s quick to adjust expectations when trading this sector:

This corner of the market is only for the most serious traders.

High-risk, high-reward…

But as to the “high-reward” part, Luke says that “there are literally hundreds of stocks that could soar 1,000% in less than a year.”

Even if we go the broad ETF route, the gains could be impressive. Circling back to XBI and its potential Stage-2 breakout channel, if bulls take over, there’s the potential for 75% – 100% returns by the summer.

So, how do you play this?

The right answer for you begins with a clear understanding of your goals.

Are you more like Eric, who sees enormous returns coming from biotech over the course of the decade?

If so, then you’re more of a buy-and-hold investor. So, pay less attention to short-term price volatility. Instead, use wise position sizes and look for ways to get broad exposure to the entire sector.

A good beginning point would be an ETF offering a basket of top biotech plays.

This approach is in line with Eric’s take:

As a non-expert of biotech stocks, I would not dare to pick specific winners and losers. Instead, I am picking the industry itself as a major winner of the nascent “AI era.”

Alternatively, if you’re more interested in capitalizing on surging biotech stocks over a shorter timeframe, consider Luke’s stage analysis approach

From this perspective, you’ll be monitoring individual biotechs by their price action, momentum, and volume.

If/when a biotech breaks into Stage 2 on 1.5X – 2X average volume, that’s your “buy” trigger.

If you want to be conservative, I suggest waiting to initiate a trade until XBI breaks above its Stage-1 resistance level of roughly $95. After all, it’s easier to make trading gains when momentum is bullish at the sector level. But if/when an XBI officially enters Stage 2, watch out – the gains could come fast and furious.

We’ll keep you updated.

Have a good evening