The plant-based meat specialist is going through tough times.

Investors have a chance to buy Beyond Meat (BYND -1.80%) stock at close to fire-sale prices these days. Yet there’s no shortage of reasons for this deep discount, which has shares trading at about half of their recent highs. The plant-based meat specialist was rocked by slumping demand following the pandemic-era sales spike. Consumers in the past year haven’t been motivated by big price cuts on its meat substitute products, either. Sales are sinking and losses are mounting.

That might not sound like a recipe for positive shareholder returns from here. However, Beyond Meat is seeing growth in some important markets outside of the core U.S. segment. Inventory is down, too. That’s good news for a company with unsold vegan foods stacking up in warehouses over the last two years. Getting the inventories down to a more manageable level should make the whole business more efficient.

And management is preparing an aggressive restructuring program that could put the company back on a path to profitability starting later in 2024. The current share price reflects lots of pessimism about the business. Against that backdrop, let’s look at whether Beyond Meat stock might be a good buy while it trades about 50% below its 52-week highs.

Unappetizing results

There hasn’t been much for investors to celebrate in Beyond Meat’s last few quarterly earnings updates. Sure, the pace of sales declines has slowed in recent months. Yet revenue still dropped 18% in fiscal 2023. Consumers aren’t snapping up its meat substitute products at grocery stores, and restaurant chains aren’t committing to as much volume, either. These sales channels were down 34% and 27% in the U.S. market last year, respectively.

The good news is that Beyond Meat is growing outside of the U.S., with especially strong demand in Europe in recent months. The company logged a 20% increase in its international division last year to offset some of the slump in its home market. Inventory levels are way down as well, pointing to the potential for stabilizing earnings ahead.

And Beyond Meat is putting the final touches on an aggressive restructuring project. “Our 2024 plan includes taking steps to steeply reduce operating expense and cash use,” CEO Ethan Brown told investors in late February.

Leave it on the shelf

There’s just too much risk around this business for most investors to feel comfortable with Beyond Meat’s stock in their portfolios, though. The company isn’t even profitable on a gross basis, after all. In other words, the cost of products sold exceeds the incoming revenues, and that’s before allocating budgets to things like sales and marketing, research and development, or management salaries. Yes, that’s partly because of one-time charges related to inventory write-downs. But the company also had to heavily discount its products to keep merchandise moving through the system. It was forced to discontinue other items, like its jerky product, that simply cost too much to manufacture.

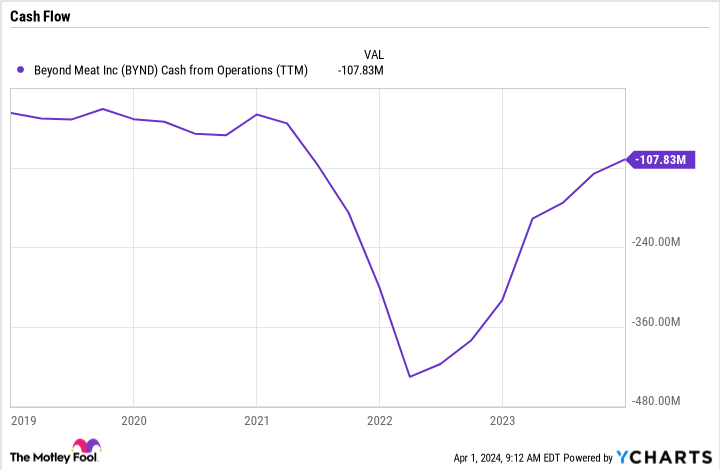

Investors should watch gross profit margin for signs that Beyond Meat is moving back toward a sustainable business model. But the more immediate worry is cash flow. The company has been burning through cash for two full fiscal years and will likely post another year of red ink in 2025 as its restructuring plan ramps up.

BYND Cash from Operations (TTM) data by YCharts

You might want to follow the stock as the details about that rebound plan emerge over the next few quarters. Beyond Meat is priced cheaply today because of its awful earnings prospects and continuing losses. Aggressive restructuring moves might send the shares higher if investors are convinced that they’ll put the company back on a profitable track. Until then, you should leave this discounted stock on the shelf.