What will tomorrow’s CPI bring? … inflation progress has been stalling … is the market too high relative to fewer potential rate cuts? … get ready for the Election Shock Summit with Louis Navellier

Tomorrow’s consumer price index (CPI) report could bring some fireworks for the market. The question is “the good kind or the bad kind?”

The headline year-over-year CPI figure is expected to have jumped to 3.5% in March, topping the 3.2% reading in February.

Remember, the Fed is looking for inflation to be on a clear, sustainable path down toward 2%. But if this CPI number comes in as expected, it will be the ninth straight month of readings at or above 3%.

Now, you could respond, “well, that’s because it’s been coming down from such a high number two summers ago, so that doesn’t mean we’re not on a path to 2%.”

That’s true, so let’s narrow our analysis.

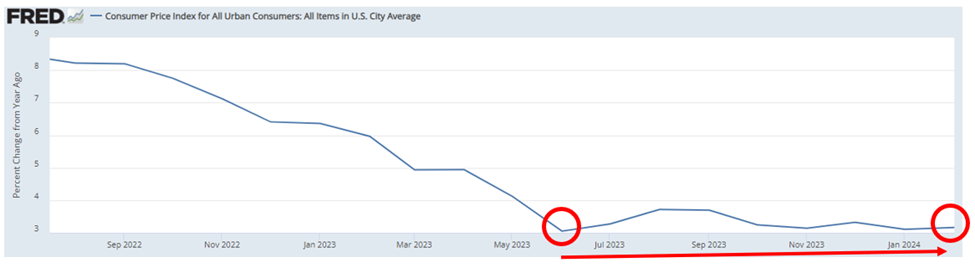

Below, we look at headline CPI inflation over the last couple years. We see it falling from those nosebleed levels.

But then, where I’ve added a red line, something else happens – a stalling out.

With June 2023’s reading of 3.053% as our baseline, the figure has actually increased as of February 2024’s reading of 3.165%.

This is not a clear, sustainable path down toward 2%.

Some market participants are looking at this and scratching their heads, wondering why the Fed is expected to cut rates three times this year

Federal Reserve Governor Michelle Bowman is one of them.

On Friday, she mentioned the possibility of raising rates again if inflation progress stalls out.

From Bowman:

While it is not my baseline outlook, I continue to see the risk that at a future meeting we may need to increase the policy rate further should progress on inflation stall or even reverse.

Reducing our policy rate too soon or too quickly could result in a rebound in inflation, requiring further future policy rate increases to return inflation to 2 percent over the longer run.

Meanwhile, even though it might feel like the market has been correcting in recent weeks, that’s not the case. As you can see below, the S&P is less than 1% beneath its all-time high.

Baked into this elevated price is “yesterday’s” narrative – namely, that we’re in for multiple interest rate cuts this year.

The issue is that if the recent trend of relentlessly strong economic reports continues – like, say, a surprisingly hot CPI reading tomorrow – then traders may be forced to recalibrate their stock market bets to be more in line with hawkish commentary like Bowman’s.

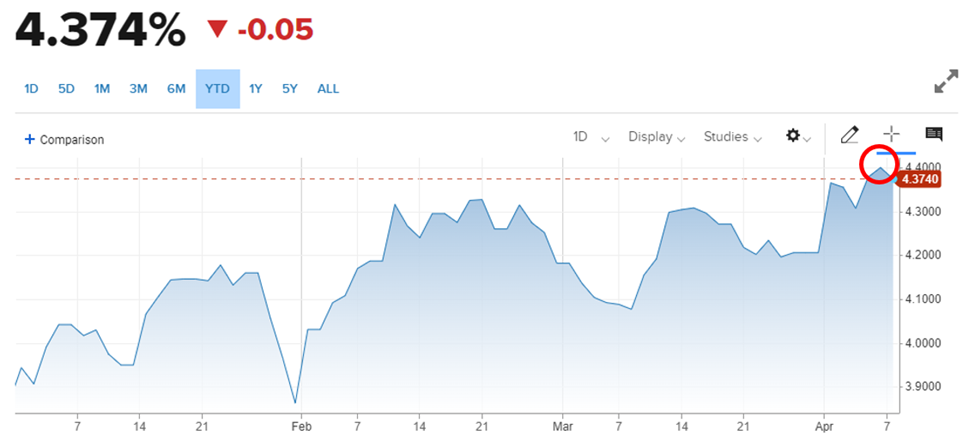

This possibility has Wall Street traders nervous about tomorrow’s CPI release, which we see reflected in the 10-year Treasury yield

For newer Digest readers, the 10-year Treasury yield is the single most important number for the global economy and investment markets. All sorts of interest rates and asset values are directly impacted by whether the 10-year Treasury yield rises or falls.

For stocks, a higher yield is typically a headwind to prices for two main reasons.

One, when analysts estimate a stock’s value, they use what’s called a “discount rate,” which is heavily influenced by the 10-year Treasury yield. Given the math involved, the higher the discount rate, the lower the net present value of a company’s future cash flows – which means lower stock prices.

Two, a higher 10-year Treasury yield entices some investors to pull their money out of stocks to benefit from this “risk free” higher yield (it’s risk free when a government bond is held to maturity). That put downward pressure on stock prices.

Regular Digest readers recognize the 10-year Treasury yield as part of the “Toxic Trifecta” which we’ve monitored for months here in the Digest.

To clarify, when the 10-year Treasury yield climbs too high, too fast, that’s when it’s “toxic” for most stock prices. When it’s cool, it’s more supportive of a bullish stock market.

As you can see below, yesterday, the 10-year yield climbed as high as 4.46% (though it’s pulled back to 4.37% as I write). This was the highest it’s been all year which makes “toxic” a fair descriptor.

However, as we just noted, the S&P sits just a hair beneath its all-time high.

So, what gives?

Shouldn’t stocks be lower in the face of all the recent data that threatens the “multiple interest rate cuts in 2024” narrative that has helped fuel this year’s stock market climb?

Maybe in theory, but in the real-world bulls continue to cling to the multiple-rate-cuts narrative, doing their best to ignore the increasing toxicity of that 10-year yield.

This is why tomorrow’s CPI report could bring fireworks. If it comes in hotter than expected, many traders might be forced to throw in the towel on their “multiple rate cuts in 2024” narrative.

But the flip side is also true…

Given the increased anxiety in today’s market, if tomorrow’s CPI data come in cooler than expected, it could fuel a strong relief rally as traders keep the multiple-rate-cut hope alive.

Is the recent uptick in inflation just a “bump” or not?

Inflation does not fall smoothly in a straight line. We shouldn’t be quick to assume that a couple, or even a few months, of higher inflation readings jeopardizes the overall downward trend.

This was the gist of Federal Reserve Chairman Jerome Powell’s message last week when he noted “it is too soon to say whether the recent [higher inflation] readings represent more than just a bump.”

Tom Lee of Fundstrat is banking on March to provide cleaner inflation data that reveals yes, the recent uptick in inflation was just a bump, not the beginning of a trend.

Here’s CNBC explaining Lee’s thinking:

…The March inflation print should represent the first solid reading of the new year, given that January inflation numbers typically struggle with poor seasonal adjustments, made worse by “the pandemic and subsequent wild goods prices swings,” while February is distorted by “residual seasonality issues – meaning, price increases in January spill into February,” Lee wrote.

“Thus, March is [the] first clean CPI print of 2024,” he said. “Or rather, we view the March CPI report as more representative of the actual trend in inflation.”

So, what does Lee believe that inflation’s “actual trend” will mean for the market?

Here he is in his note to clients:

Bottom line: We see probabilities favoring a rally in stocks post-March CPI report.

Looking closer to home, legendary investor Louis Navellier is still calling for the first rate cut to happen in June

Here’s Louis explaining:

One reason is because of what Christine Lagarde, the president of the European Central Bank (ECB), said during a speech in Frankfurt, Germany. Lagarde stated that “by June we will have a new set of projections that will confirm whether the inflation path we foresaw in our March forecast remains valid.”

So, it looks like the major central banks – the Federal Reserve, ECB and the Bank of England – are planning to cut rates at the same time.

In other words, come June, we will see worldwide rate cuts. By coordinating their rate cuts, the central banks should be able to keep the currencies in sync.

But Louis has a friend who disagrees. And tomorrow at 8 PM Eastern, the two analysts will be discussing their perspectives in a live event called the Election Shock Summit.

Back to Louis:

A friend of mine, who is also an experienced analyst, has a different date in mind [for when the Fed will enact its first rate cut]. So, I’ve invited him to join me for my Election Shock Summit so he can explain why (his answer may surprise you).

He’ll also share when he expects the Fed to cut rates, and why the May FOMC meeting could have a massive impact not only on the stock market but on the presidential election.

Plus, we’ll talk about how to best position your portfolio to profit.

You can reserve your seat for tomorrow night’s free event by clicking here.

Wrapping up, let’s return to Bowman’s comments from last Friday:

Given the risks and uncertainties regarding my economic outlook, I will continue to watch the data closely as I assess the appropriate path of monetary policy, and I will remain cautious in my approach to considering future changes in the stance of policy.

Once again, “the data” are back in the spotlight, which puts significant pressure on tomorrow’s CPI print.

We’ll keep you updated here in the Digest.

Have a good evening,

Jeff Remsburg