Bitcoin is down 14% from last week’s high … is it a buying opp or a warning? … how Bitcoin behaves around its halvings … global demand drivers … watch out for the government

Last Thursday, Bitcoin notched its all-time high of $73,835.57.

But here we are, not even one week later, and it’s down 14% to $63,256 as I write Tuesday morning.

If you’ve been on the sidelines, looking for your chance to get into this historic Bitcoin move, is this your window to buy? Or is this an ominous prelude to a larger crash that you want to avoid?

To help us answer these questions, let’s go to our crypto expert, Luke Lango.

From Luke’s weekend issue of Crypto Investor Network:

The crypto bull market remains alive and well, despite the pullback we experienced [last] week due to macroeconomic headwinds.

Inflation ran hot all week, with the Consumer Price Index (CPI) data on Tuesday, Producer Price Index (PPI) on Thursday, and import-export prices on Friday all coming in above expectations. This stabilization in inflation, rather than a continued decline, creates a short-term headwind for cryptocurrencies.

However, we believe this won’t last.

Inflation is stabilizing at long-term “normal” levels, and the market will eventually grow comfortable with that. When it does, risk sentiment will improve, and investors will pile back into cryptos.

A good buying opportunity is coming up, but not just yet.

The technical picture for Bitcoin (BTC-USD) tells us we haven’t bottomed out. Let the selloff continue, and we will let you know when it’s time to buy the dip.

Some historical context for Bitcoin’s volatility leading into the halving, which is happening next month

If you’re new to the Digest, the halving is an event specific to Bitcoin in which “Bitcoin miners” (think, computer whizzes) solve complex computer puzzles to release new Bitcoin. Their reward for doing so is an amount of Bitcoin that’s already predetermined by the system.

Each halving reduces this reward by half, hence the name “halving.” This time around, the reward per block of mined Bitcoin will decrease from 6.25 to 3.125.

Historically, these halving events have been very bullish for Bitcoin’s price for months on either side of the event. But right around the actual halving itself, history suggests we should brace for a substantial correction.

Rekt Capital recently published a fantastic review of what happens with Bitcoin’s price leading up to a halving.

In short, around 60 days before the event, a pre-halving rally begins. It builds steam, attracting “me too” investors who care nothing for Bitcoin, they just want in on the action.

With prices surging and the halving approaching, the early money then takes its profits, selling to these “me too” investors. Historically, this results in a substantial correction in the weeks surrounding the halving.

In 2016’s halving, the correction was -38% deep. In the 2020 correction, it was a -20% drop.

I’ve asked Luke about the potential size of this drop in 2024. He thinks 20% is a reasonable estimate this time around, though that’s just a broad guideline.

Regardless of its size, let’s return to Rekt Capital for the impact of this pre-halving drawdown on investors, and then, historically, what follows:

This Pre-Halving retrace makes investors question whether the Halving was a bullish catalyst on price after all.

The Pre-Halving retrace is followed by multi-month re-accumulation.

Many investors get shaken-out in this stage due to boredom, impatience, and disappointment with lack of major results in their BTC investment in the immediate aftermath of the Halving.

Once Bitcoin breaks out from the re-accumulation area breakout into the parabolic uptrend. It is during this phase Bitcoin experiences accelerated growth on its way to new All Time Highs.

Whether we’ve begun this traditional “pre-halving correction” or this is just a milder pullback, keep in mind what history suggests is on the other side of the halving…

A much higher price for Bitcoin.

We’ve seen all sorts of predictions for what this means, and yesterday brought another, this time from global banking giant Standard Chartered. If you haven’t heard of it, that’s because it mostly services Asia, Africa, and the Middle East. But it’s a massive bank with nearly $900 billion in assets.

Standard Chartered just upped its 2024 price target from $100,000 to $150,000. It then sees the rally continuing into 2025, with Bitcoin topping $250,000 before settling around $200,000.

It’s important to remember that these higher price predictions aren’t pulled from thin air. They reflect, in part, the growing global adoption of Bitcoin and various altcoins.

Let’s go back to Luke for examples of this:

Major players like Coinbase and MicroStrategy continue to invest heavily in Bitcoin. Meanwhile, institutional investors such as BlackRock are experiencing significant inflows into their spot Bitcoin ETFs.

The London Stock Exchange’s decision to start accepting Bitcoin and Ether ETN applications in Q2 further solidifies the growing acceptance of cryptocurrencies in traditional finance.

Mastercard and the popular crypto wallet MetaMask are beginning to test the first blockchain-powered payment card.

Outside the United States, the BRICS nations are developing a blockchain payment system. Thailand has greenlit income tax exemptions for investment token earnings, and Hong Kong has launched a sandbox for stablecoin issuers.

While the market may experience short-term volatility, the long-term outlook for cryptocurrencies remains incredibly promising.

And for just a bit more evidence of the ravenous demand for Bitcoin, consider this…

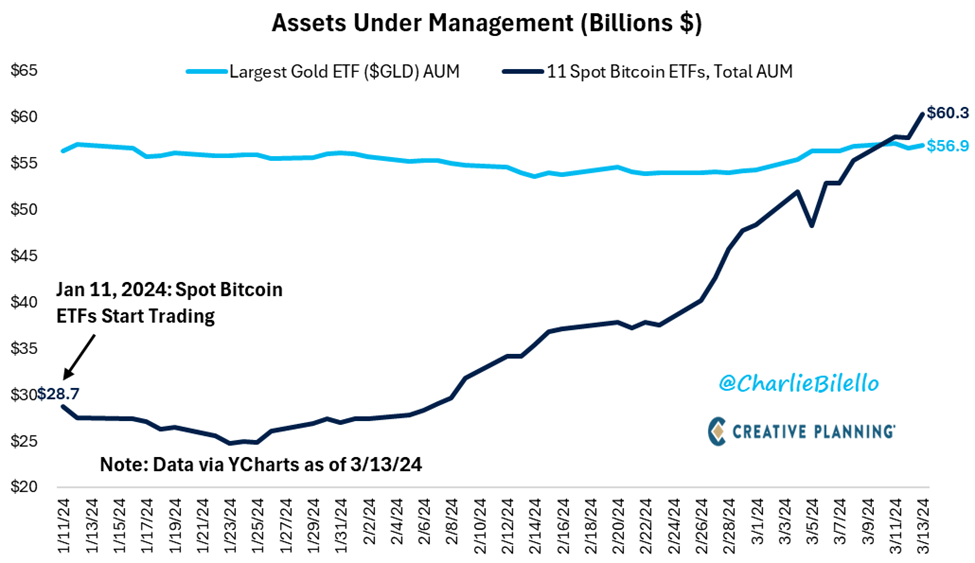

Analyst Charlie Bilello recently posted on X how the total assets in the 11 spot Bitcoin ETFs have crossed above $60 billion. That’s more than $3 billion higher than the assets under management of the largest Gold ETF ($56.9 billion in GLD, which is the SPDR Gold Trust).

More impressive, it took just seven weeks for the iShares Bitcoin ETF IBIT to pass $10 billion in assets. That is the fastest growth for an ETF ever.

The prior record was held by the gold ETF. But guess how long it took to pass the same $10 mark…

More than two years.

Here’s the AUM of Bitcoin ETFs’ topping GLD’s assets last week.

Keep your eye on this potential hiccup

You always must be careful when the government gets involved.

Unfortunately, it appears the government wants more say in the crypto sector.

From Forbes on Sunday:

Bitcoin and crypto prices have surged back this year, thrusting bitcoin into the limelight…

[But] U.S. president Joe Biden has been accused of trying to “destroy” crypto in the U.S. and “wipe out billions of dollars of investor value.”

This week, the Biden administration reintroduced a controversial proposal for a tax on bitcoin and crypto miners who use high powered computers to secure crypto networks and verify transactions.

“Any firm using computing resources, whether owned by the firm or leased from others, to mine digital assets would be subject to an excise tax equal to 30% of the costs of electricity used in digital asset mining,” the U.S. Treasury Department wrote in its 2025 revenue proposal.

“Implementing a blanket 30% federal tax on digital mining will certainly kill the sector and wipe out billions of dollars of investor value virtually immediately in the U.S.,” Taras Kulyk, the chief executive of mining hardware company SunnySide Digital, told DL News.

The digital asset mining energy tax (Dame), first proposed a year ago, would impose a 30% excise tax on bitcoin and crypto miners electricity costs, likely forcing them to flee the country as they did from China when it cracked down on miners in 2021.

It’s critical that we keep an eye on this. If this digital tax is pushed through, it will reverberate throughout the entire sector – and your crypto portfolio.

Let’s hope that our politicians drag their feet per usual. That would give us time to get beyond the pre-halving correction, and hopefully, well into the post-halving boom.

For more of Luke’s crypto research, and to learn which altcoins he’s betting will benefit the most from the post-halving surge, click here to join him in Crypto Investor Network.

Have a good evening,

Jeff Remsburg