Personalized health screening from a “smart toilet” … how AI will revolutionize healthcare … transformative wellness care and bottom-line cost savings … how our experts are playing it

It’s a day not too far off in the future…

You wake, enjoy a cup of coffee, then make a trip to the bathroom. Only this is no regular bathroom…

Your home now has a “smart toilet.” Powered by artificial intelligence, it analyzes your deposit in real time, scanning for the first sign of any illness or disease.

Here’s Sanjay Mehrotra, chief executive of Micron Technology:

You don’t need to be going to visit a physician every six months. If any sign of disease starts showing up, you’ll be able to catch it much faster because of urine analysis and stool analysis.

Now, hopefully your smart toilet doesn’t detect any irregularity. But if it does, what then?

Instead of scheduling an appointment with your doctor in a week or two, after which she’ll prescribe a traditional one-size-fits-all medication that may or may not be effective and/or have unwanted side effects, artificial intelligence begins working immediately.

Based on the AI’s familiarity with your specific genomic profile, factoring in the nature of the illness/health irregularity detected, your AI healthcare network will engineer a tailormade medication that’s unique to you and the medical complication.

Welcome to the age of AI and personalized healthcare.

Here’s Forbes with more:

AI will make it possible, and affordable, for every individual to have access to their genome—to what makes them unique.

This is critical: Every human is distinct, and the human body and its interactions with pathogens or diseases differ by individual. Hence, to mitigate the most severe consequences of life-altering diseases like Alzheimer’s and chronic diseases like diabetes, the treatments and protocols should also be uniquely received by the individual.

AI-enabled personalized medicine can eliminate much of the guesswork from diagnosis and treatment plans.

Personalized medicine shifts the practice from statistics, the law of averages and hopes and prayers for the best outcome to more precisely and explicitly identifying abnormalities within the individual patient based on their DNA, their medical history and their family’s medical history.

This week, you may have noticed more guest essays in the Digest than usual

That’s because I was attending InvestorPlace’s Big Ideas Conference. It was a fantastic week with presentations from Louis Navellier, Eric Fry, Luke Lango, and a handful of key team members.

The conference provided a forum for our experts to showcase the most influential investment opportunities they’re excited about today. These are the game-changers – the investment set-ups offering the greatest portfolio-transforming firepower.

Among the handful of big ideas presented, there was one idea that Louis, Eric, and Luke not only agreed upon, but was at the top of their respective lists…

The union of AI and healthcare.

As I wrote in yesterday’s Digest , it’s hard to overstate AI’s coming impact on healthcare – both in terms of its influence on your personal wellness and longevity, as well as for the bottom lines of companies in the sector.

Let’s look at why…

AI will revolutionize healthcare in two huge ways – better wellness care for you, and lower costs for health providers

A moment ago, we looked at early diagnostic screening and precision medicine. Here’s another example of the game-changing impact of AI from Medical Economics:

Nursing is also seeing the effects of AI, and in the future, some nursing functions could be handled by an autonomous digital nurse named Florence.

Generated Health and the College of William & Mary have joined forces to develop next-generation AI, aiming to revolutionize the automation of synthetic patient data to train an autonomous digital nurse using generative AI and reinforcement learning.

Reinforcement learning is a type of machine learning where in this case, the digital nurse, learns to make decisions by interacting with patients and clinical workflows. The digital nurse receives feedback in the form of positive or negative rewards based on the actions it takes with the objective of learning strategies that maximize the cumulative reward over time…

Ingolv Urnes, CEO of Generated Health, said the company’s mission it to deploy one million digital nurses to enhance health care accessibility while reducing costs. Generated Health has already demonstrated the efficacy of combining protocols and AI for better health outcomes.

So far, we have personalized health screenings, precision medications, and digital nurses. What else is coming?

Well, what about medical device innovations?

Here’s our macro expert Eric Fry of Investment Report:

According to Grand View Research, artificial intelligence will become a key driver of medical device innovation over the coming decade.

The research firm predicts the AI component of the healthcare market will skyrocket from $15.4 billion in annual sales last year to more than $200 billion in 2030. That’s a compound annual growth rate of 37.5%…

Healthcare functions such as diagnostics, patient management, medication management, claims management, workflow management, integration of machines, and cybersecurity saw a remarkable surge in the integration of AI/ML technologies.

But we can’t stop there either. AI holds the promise of radically transforming/ improving just about everything related to healthcare.

Here’s EMarketer with just a few of the ways that Big Tech is already moving in the space:

Amazon is setting up initiatives to transform pharmacy, the medical supply chain, health insurance, and care delivery…

Apple is using its popular consumer-facing products, like Apple Watch and iPhone, to forge partnerships with payers, health systems, and clinical researchers…

Alphabet is using its dominance in data storage and analytics to patch up interoperability challenges and streamline clinical research…

Microsoft’s health play hinges on its cloud platform, Azure, and the data analytics prowess it can provide healthcare firms…

And if you hadn’t already jumped to this conclusion, here’s why Big Tech is moving so aggressively into the space, from CNBC:

[There is a Big Tech] red-hot AI arms race, where tech companies are competing to dominate a market that analysts believe could someday be worth trillions.

The financial opportunity is so enormous that even Nvidia, which now has a market cap of $2.4 trillion, anticipates needle-changing growth.

Here’s a CNBC headline on this point from earlier this week:

Nvidia makes it clear its best days are still ahead – and health care is one reason why

From an investment perspective, this is not a “wait until next decade to benefit” set-up – rather, triple digit returns are happening today

Yes, there will be your “buy-and-hold” health care plays. But the idea that you must wait three, five, or 10 years to see a big return from AI-goosed biotech stocks is inaccurate. We’re already seeing triple digit returns.

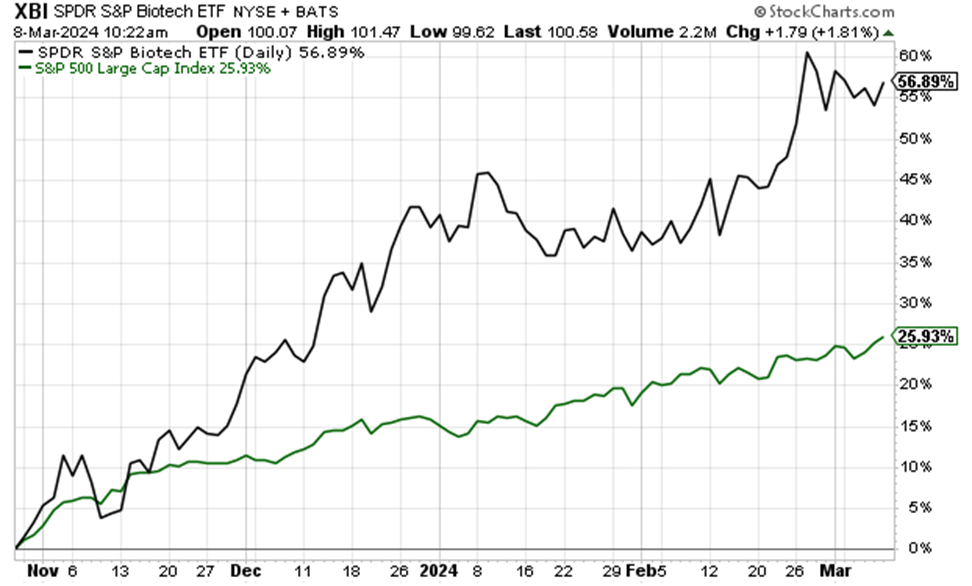

Even broad ETFs are soaring. For example, in yesterday’s Digest, we highlighted the SPDR S&P Biotech ETF XBI. It’s up 57% since late-October, more than doubling the S&P’s performance.

But that’s nothing compared with how some individual biotech stocks are performing.

Here’s Luke:

Year-to-date, Elevation Oncology (ELEV) is up more than 800%. Skye Bioscience (SKYE) is up more than 500%, and Corbus Pharmaceuticals (CRBP) is up about 500%.

Why the huge breakout in biotech?

In part, it’s thanks to AI.

AI’s application in biology holds the potential to unlock enormous economic value for one simple reason: data.

To be clear, this isn’t cherry picking. Significant gains are happening in real time for ordinary investors.

Take Luke’s High Velocity Stocks trading service. For newer Digest readers, this is a service in which Luke applies a trading framework called “stage analysis” to the biotech sector.

I just looked at the portfolio. Of the 10 open positions:

- There’s a 160% gainer, opened on January 9th…

- A 141% winner, opened on January 23rd…

- A 135% winner, from August 8th…

- A 51% winner, from November 14th…

The average return of the entire portfolio is roughly 56%, and there isn’t a position that’s older than last August. Six of the 10 positions were opened within the last three months.

But if you don’t want to trade small biotechs to play this opportunity, you don’t have to

At the conference, Eric made an interesting point…

Many mega-cap healthcare companies are currently on a spending spree, buying up small-cap biotech companies to access their valuable intellectual property, patents, and pipelines.

Eric likened these acquisitions to “call options,” wherein any one of them could be tomorrow’s bottom-line game-changer for the parent mega-cap company.

So, by investing in a more stable, mega-cap biotech/healthcare company, you’re still getting some exposure to moonshot potential, though a diluted version.

If this type of investment approach better fits your temperament, check out stocks like Merck, Amgen, or Gilead. They won’t have the same volatility fingerprint as a microcap biotech, yet their acquisitions could pay off handsomely.

Meanwhile, as you wait for the potential “call options” to bear fruit, you’re enjoying a 2.5% dividend yield from Merck, a 3.3% dividend yield from Amgen, and a 4.1% dividend yield from Gilead.

To join Eric in Investment Report to access his AI/healthcare research and learn the specific ways he’s playing it today, click here. And to see which healthcare stocks Luke is adding to his Innovation Investor portfolio, click here.

Wrapping up, you and I have the incredible good fortune of being at the very beginning of this before-and-after line in the sand

And while that’s exciting from a moneymaking perspective, let’s end today by looking broader.

The real benefit isn’t a few extra dollars in our pockets (even though this has the potential to be vastly more impactful than “a few extra dollars”), it’s found in the enhanced wellness of you and your loved ones.

On that note, let’s end today by returning to Forbes:

Over the next several years, I believe we’ll reach a point where an individual’s health will be nearly pristine. The advances in medical science and medical technologies will be at a point where we fear disease less and less…

The ability for us to prolong life meaningfully is going to increase tremendously. We will find strategies to mitigate Alzheimer’s and chronic conditions like heart disease and diabetes without affecting the quality of life.

This is going to become the norm rather than the exception. The enablers for this will be technology and the significant research accomplished using advanced techniques, AI being at the heart of them.

If humankind should invest in one thing to further itself, it should be AI in healthcare, because life is our most precious thing.

Have a good evening,

Jeff Remsburg