NASDAQ:LGND

READ THE FULL LGND RESEARCH REPORT

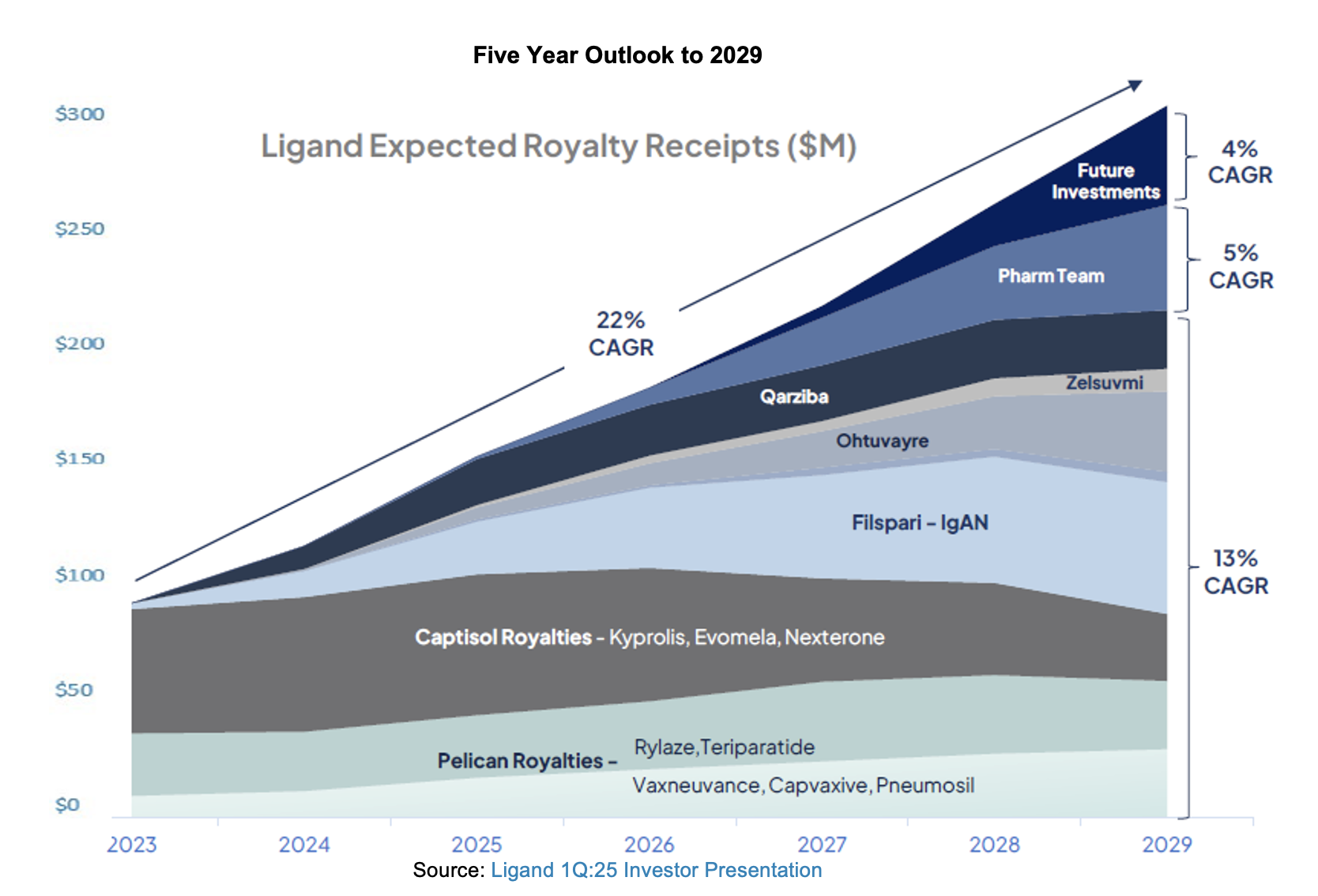

Ligand Pharmaceuticals, Inc. (NASDAQ:LGND) reported first quarter 2025 financial and operational results posting revenues of $45.3 million, a 46% rise over prior year levels. Drivers for the result were a seven-fold increase in financial royalty revenue, a 46% increase in Captisol revenue and a 64% increase in Contract Revenue. Some of the individual portfolio constituents contributing to the year over year increase were Filspari, up almost 200%, a dramatic rise in Ohtuvayre and better than expected sales for Capvaxive.

Adjusted core earnings per share were $1.33, up from 1Q:24’s $1.20. Ligand maintains 2025 guidance of low teens revenue growth and earnings of $6.00 to $6.25 per share. Since the previous financial update, Ligand announced that it has identified a suitor for Pelthos Therapeutics, which will begin commercialization of Zelsuvmi and complete the transaction with Channel Therapeutics in 3Q:25.

1Q:25 Financial and Operational Results

Ligand reported first quarter 2025 results in a press release and Form 10-Q filing with the SEC on May 8th. A conference call was held with an accompanying slide deck to discuss results with investors following the release. For the quarter ending March 31st, 2025 revenues of $45.3 million were recognized. GAAP net loss per share for 2024 totaled ($2.21) and core adjusted EPS was $1.33. For first quarter 2025 versus the same prior year period:

- Revenues of $45.3 million rose 46% from $31.0 million due to strong growth in all reportable segments. Royalty revenues rose by 44% driven by contributions from the acquisition of Qarziba and an increase in Filspari sales. Captisol sales rose 46%, with the increase attributed to timing of customer orders. Contract revenue was up 64% primarily due to the receipt of a regulatory milestone tied to Xi’an Xintong’s Xinshumu (pradefovir mesylate tablets);

- Cost of revenue, which is related to Captisol, totaled $4.8 million, an increase from $2.9 million. This represents a gross margin on Captisol sales of 64.0%, down from 68.7%;

- Amortization of intangibles increased slightly to $8.3 million vs. $8.2 million;

- Research and development expense totaled $50.1 million vs. $6.0 million rising more than seven-fold due to the recognition of research and development funding for the investment to acquire D-Fi royalty rights in conjunction with the Castle Creek investment;

- General & Administrative expenses were $18.8 million, up 72% from $11.0 million due to due to employee-related and operating costs associated with incubating the Pelthos business;

- Other adjustments include a ($0.4) million adjustment to partner program derivatives, a $12.4 million loss from short term investments, $0.9 million in net interest income, and ($2.5) million of other non-operating expense. Total other items of about ($14.0) million compare to $110.5 million with prior year results impacted by a recognition of a gain due to appreciation in Viking Therapeutics stock;

- Income tax benefit of $7.7 million compared to income tax expense of $27.3 million reflecting the GAAP pre-tax loss recognized in 1Q:25;

- Net loss was ($42.5) million vs. $86.1 million or ($2.21) and $4.75 per share, respectively. Adjustments to 1Q:25 GAAP earnings added back $3.54 per share to generate core earnings of $1.33 per share.[1]

As of March 31st, 2025, cash, equivalents and short-term investments totaled $209 million. This amount compares to the $256 million balance held at the end of 2024. Operational cash use and purchase of property and equipment in the first quarter totaled ($25.7) million while cash used in financing consumed ($4.7) million related to the payment of taxes related to equity awards. The company maintains access to a revolver credit and an at-the-market (ATM) facility with Stifel, Nicolaus that can expand its access to capital as needed. Ligand maintained its 2025 guidance for revenues from $180 – $200 million and core EPS of $6.00 – $6.25.

Program Updates

During its earnings call and presented in the associated materials related to the 2024 financial and operational review, Ligand updated stakeholders on its key programs:

- Ohtuvayre (Verona)

- Reported net sales of $71.3 million in 1Q:25, a 95% sequential increase

- Growth driven by significant increase in prescriptions, prescribers, new patients & refills

- Qarziba (Recordati)

- Royalty revenue of $5.4 million recognized

- Recordati will continue the geographic expansion of Qarziba

- Qarziba may expand into Ewing sarcoma

- Filspari (Travere)

- The European Commission approved Filspari for standard marketing authorization for adults with primary IgA nephropathy – April 2025

- sNDA submitted to FDA for Filspari approval in FSGS

- Final kidney disease outcomes (KDIGO) in 2025

- Urogen (UGN-301)

- Announced Phase I safety data for UGN-301 in recurrent non-muscle invasive bladder cancer

- Palvella (Qtorin rapamycin)

- Presentation of data at the 15th World Congress of Pediatric Dermatology

- First patients dosed in Phase II TOIVA study – January 2025

- Phase III SELVA to be expanded to enroll younger children – February 2025

- Capvaxive (Merck)

- European Medicines Agency (EMA) approves Capvaxive

Summary

Ligand generated 46% topline growth in 1Q:25, producing $45.3 million in revenue. Contributions from legacy and new royalty assets, along with positive results from Captisol and the receipt of a milestone from Xi’an Xintong contributed to the growth. Guidance for the year was reaffirmed.

Since the beginning of the year, Ligand made an investment in its first gene and cell therapy asset through a syndicated deal with Castle Creek Biosciences. This agreement offers a mid-single-digit royalty worldwide on an asset that could generate up to a billion dollars. Following the end of the quarter, management announced that it had found a suitor for Pelthos to provide a vehicle for commercializing this asset. In the presentation and investor materials, the team provided updates for all of the major programs in its portfolio, highlighting better than expected revenues in several assets and development and regulatory advancement in others.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives quarterly payments totaling a maximum fee of up to $40,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.

________________________

[1] Details of the GAAP to core earnings reconciliation are in Ligand’s earnings press release.