Consider estate planning strategies to minimize the impact of taxes on your estate. Our Bill Cass highlights several key actions including document reviews, naming beneficiaries and the use of 529 college savings plans to enhance tax efficiency.

Given that most tax provisions of the Tax Cuts and Jobs Act are currently set to expire at the end of 2025, including the lifetime estate and gift tax exclusion, a review of estate plans seems prudent. While the future of estate and gift-tax policy is uncertain, there are important actions to consider now that could have an impact on the overall tax efficiency of an estate plan.

Here are five estate planning strategies to consider that could maximize a plan’s tax efficiency.

Plan for the 10-year rule on inherited IRAs

Since most non-spouse beneficiaries will have to liquidate inherited IRAs within 10 years following the death of the account owner and likely pay taxes upon distribution, there may be strategies to transfer retirement savings in a tax-smart manner to the next generation. For example, consider naming heirs who are more likely to be in lower tax brackets as IRA beneficiaries. For 2025, there are new rules for inherited retirement accounts that need to be followed. Beginning this year, many heirs subject to the 10-year distribution rule will also, at a minimum, need to take a minimum distribution based on their remaining life expectancy. This applies on inherited account where the original owner died after reaching their required beginning date (RBD). For more details see our article, “Unwinding the 10-year rule for inherited retirement accounts.”

Review estate planning documents and strategies

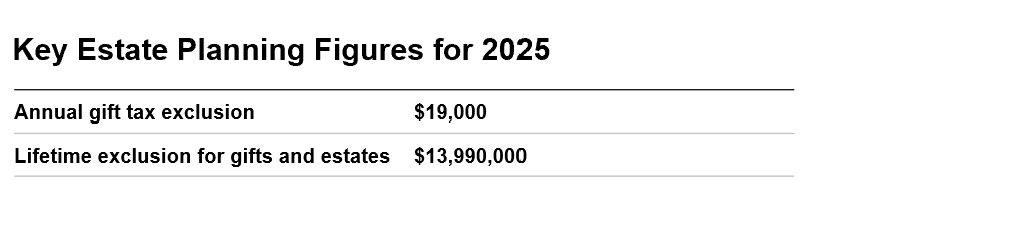

Beginning with tax law changes effective in 2018, the increase in the lifetime exclusion amount for gifts and estates ($13,990,000 per individual in 2025) may have unintended consequences for some individuals and families with wealth comfortably under that threshold. They may think that they do not have to plan for their estate. However, taxes are just one facet of estate planning. It is still critical to plan for an orderly transfer of assets or for unforeseen circumstances such as incapacitation. Strategies to consider include proper beneficiary designations on retirement accounts and insurance contracts, wills, powers of attorney, health care directives and revocable trusts. Additionally, existing trusts should be reviewed to determine if changes are needed based on the current gift and estate tax thresholds.

Plan for potential state estate taxes

While much attention is focused on the federal estate tax, certain residents need to know that many states have estate or inheritance taxes. There are several states that are “decoupled” from the federal estate tax system. This means the state applies different tax rates or exemption amounts. A taxpayer may have net worth comfortably below the $13,990,000 exemption amount for federal estate taxes but may be well above the exemption amount for their state. For example, estates in Oregon with net worth higher than $1 million may be subject to state taxes. It is important to consult with an attorney on specific state law and potential options to mitigate state estate or inheritance taxes

Develop a strategy for low-cost-basis assets

Ensure stepped-up cost basis is maintained when property is transferred at death. For example, careful consideration should be made around lifetime gifts that may jeopardize a step-up in cost basis on property at death. When property is gifted, the party receiving the gift generally assumes the original cost basis. Additionally, certain trust provisions may be utilized to ensure that property receives a step-up in cost basis at death.

Expand use of 529 accounts for education savings

529 college savings plans are great tools for funding a variety of education-related expenses including K-12 tuition in some states, qualified apprenticeship programs and higher education expenses. Additionally, a special provision allows individuals to front-load five years of annual gifts as a contribution into a plan. With the annual gift tax exclusion at $19,000 for 2025 that means that up to $95,000 (or $190,000 for married couples) can be contributed into a 529 account while not exceeding current gift limits (assuming no other gifts are made during the next five years). This may allow for a larger removal of assets from an estate once the contribution into the 529 account has occurred.

Seek advice

Consult a qualified tax or legal professional and your financial advisor to discuss these types of strategies. It is critical to work with a professional who has knowledge of your specific goals and situation.

For more planning strategies, see “Ten income and estate tax planning strategies for 2025.”

—

Originally Posted February 19, 2025 – Five estate planning ideas for 2025

Disclosure: Franklin Templeton

The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Franklin Templeton and is being posted with its permission. The views expressed in this material are solely those of the author and/or Franklin Templeton and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Divulgación: IBKR Taxes

Interactive Brokers no proporciona asesoramiento fiscal, no realiza declaraciones sobre las consecuencias fiscales específicas de ninguna inversión y no puede asistir a los clientes con la presentación de impuestos. Los inversores deben consultar a un accesor de impuestos sobre las implicaciones fiscales de cualquier inversión

Disclosure: Tax-Related Items (Circular 230 Notice)

The information in this material is provided for informational purposes only and does not constitute tax advice and cannot be used by the recipient or any other taxpayer to avoid penalties under any federal, state, local or other tax statutes or regulations, or to resolve any tax issue.