For a few months now, I’ve been referring to today’s heightened geopolitical climate as the “new red Cold War,” where artificial intelligence (AI)—not necessarily fighter jets and nuclear weapons—serves as the primary battleground between the U.S. and its adversaries, most notably Russia and China.

The numbers tell a compelling story. According to one research firm, the global AI market in aerospace and defense is projected to surge from approximately $28 billion today to a staggering $65 billion by 2034. That’s a solid 9.91% compound annual growth rate (CAGR). North America alone represents $10.43 billion of this market, and it’s growing even faster at 10.02% annually.

Palantir’s Meteoric Rise

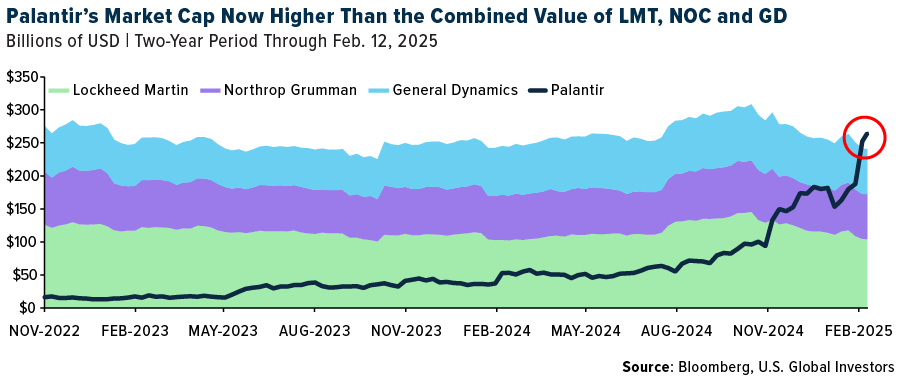

We’re seeing a dramatic reshuffling of the traditional defense sector hierarchy.

Take Palantir Technologies. The AI-focused company—founded in 2003 by Peter Thiel, among others, and named for a magical artifact from Lord of the Rings—has seen its stock soar approximately 61% so far this year, after returning a massive 340% in 2024.

Meanwhile, traditional defense giants like Lockheed Martin, Northrop Grumman and General Dynamics have been struggling, with their combined market value now lower than that of Palantir, whose chief technology officer, Shyam Sankar, recently called the competition between the U.S. and China an “AI arms race.”

And let’s not discount the influence of Elon Musk’s cost-cutting Department of Government Efficiency (DOGE) initiative. We could see a push to modernize military procurement, prioritizing software, drones and robots over traditional hardware. DOGE has already sent tremors through the defense sector, with traditional contractor stocks taking hits as new players like SpaceX, OpenAI and Anduril Industries gain ground.

Vice President Vance Pushes for AI in Paris

This shift isn’t happening in a vacuum, of course. The Trump administration, with Vice President JD Vance at the forefront, is actively pushing for AI development while taking a notably different approach from our European allies.

At the AI Action Summit in Paris last week, Vance made it clear that the U.S. won’t let excessive regulation stifle innovation in this critical sector. “We need our European friends in particular to look to this new frontier with optimism rather than trepidation,” Vance told the audience, which included world leaders, CEOs and scientists from over 100 countries.

This pro-growth stance has already benefited U.S. chipmakers like Intel, whose shares ended last week up more than 23% on news of increased support for domestic chip production. The company has its work cut out for it: Today, some 90% of the world’s most advanced chips are made by the Taiwan Semiconductor Manufacturing Company (TSMC).

Even Google, once hesitant about military contracts, has reversed its stance on AI weapons development. This shift signals a broader change in Silicon Valley’s relationship with defense contracts, opening up new investment opportunities in tech companies that previously stayed away from the sector.

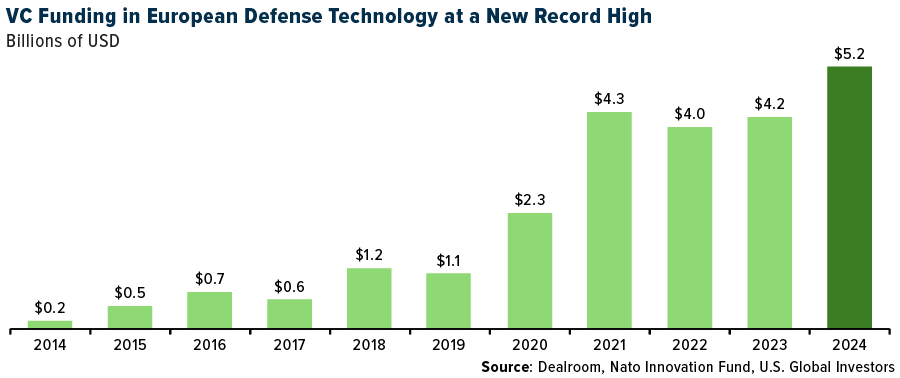

Europe’s Defense Tech Boom Is Just Getting Started

The transformation isn’t limited to the U.S. Facing its own security challenges with Russia, Europe is seeing unprecedented growth in defense tech investment. Venture capital (VC) funding in defense technology hit a record $5.2 billion in 2024, according to a new report by Dealroom data. This marks an incredible fivefold jump from six years ago, making defense one of the fastest growing VC sectors in Europe right now.

For investors, this creates what I see as a once-in-a-generation opportunity. Defense Secretary Pete Hegseth’s target of 3% of GDP for defense spending—roughly $1 trillion annually—suggests sustained government investment in the sector, despite Musk’s promise to cut costs. The key question isn’t whether there will be spending, but rather which companies will capture it.

Positioning for the Biggest Defense Tech Shift in Decades

So where should investors be looking? I see three key areas:

First, companies at the intersection of AI and defense, like Palantir, that are already proving their worth in military applications. These firms are positioning themselves as essential partners in modern warfare capabilities.

Second, domestic semiconductor manufacturers like Intel that are critical to both AI development and national security. The Trump administration’s focus on U.S. production could provide significant tailwinds for these companies.

And third, emerging defense tech companies that are disrupting traditional military procurement. While many are not publicly traded yet—Anduril being one such example—keeping an eye on this space could reveal early opportunities as they come to market.

We’re witnessing the biggest transformation in defense technology since the advent of nuclear weapons, and I believe that those who position themselves in this new “AI arms race” could see substantial returns as this multi-decade trend unfolds.

If you haven’t already, be sure to watch our latest video, “The New Red Cold War: China, Russia and the Battle for Global Power,” by clicking here!

—

Originally Posted February 18, 2024 – Silicon Valley Conquers the Pentagon as Defense Tech Explodes

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (12/31/2024): General Dynamics Corp., Taiwan Semiconductor Manufacturing Co. Ltd., Alphabet Inc.

The compound annual growth rate (CAGR) is the annualized average rate of revenue growth between two given years, assuming growth takes place at an exponentially compounded rate.

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.