SoundHound AI (SOUN 0.64%) has been one of the most volatile stocks of the artificial intelligence (AI) era, and that pattern continued in January.

In a rough month for AI stocks, SoundHound, which provides AI voice technology for carmakers, restaurant chains, and others, finished on the losing side, but it wasn’t Chinese AI start-up DeepSeek that spoiled the month.

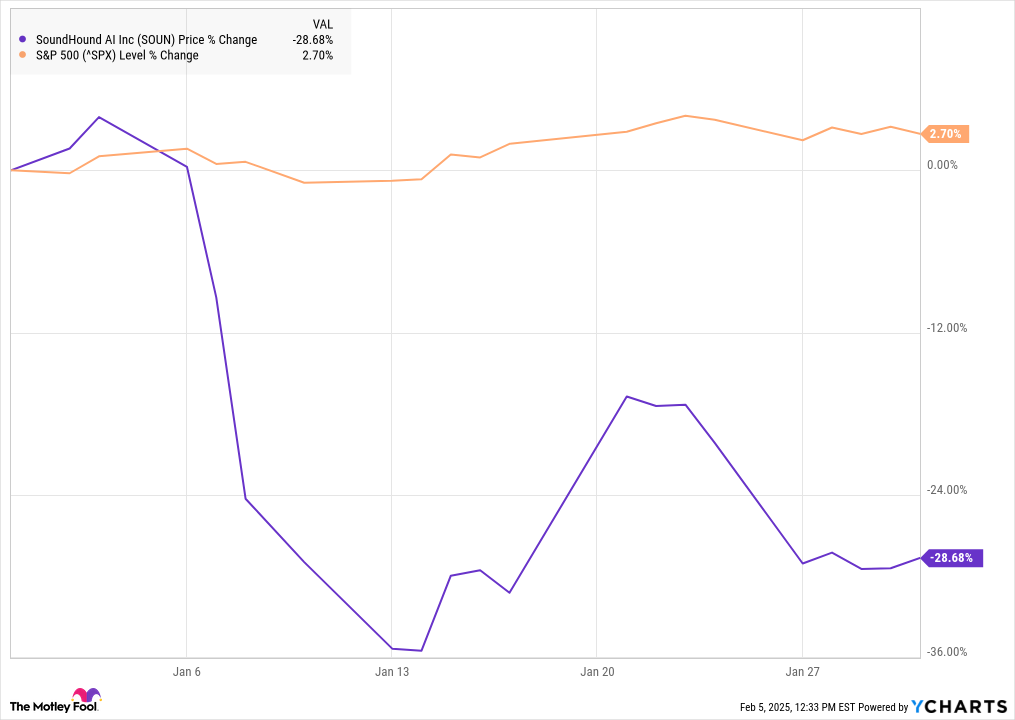

The stock’s slide came predominantly during the week of CES, which took place Jan. 7 through 11, as some of its competitors made some important strides, and investors seemed unimpressed with SoundHound’s presentation.

By the end of the month, the stock had fallen 29%, according to data from S&P Global Market Intelligence. As you can see from the chart, most of those losses came in the second week of the year.

SoundHound faces new competition

SoundHound fell during CES, formerly known as the Consumer Electronics Show, as it disappointed investors with its own presentation, while rival Cerence AI impressed the market. Cerence announced a new automotive collaboration with Nvidia, which is also an investor in SoundHound.

SoundHound unveiled new technology that essentially enables customers to have a dialogue through their car to allow them to find and order take-out food.The stock fell 10% on Jan. 7, the day that news was announced, and continued to slide from there, a sign Wall Street had higher hopes for the presentation.

However, SoundHound bounced back on Jan. 21 when the stock jumped 21% after it signed up Rekor, a roadway intelligence technology company, to partner with SoundHound to help emergency personnel like police, fire, and rescue use voice commands for systems like license plate recognition.

SoundHound couldn’t hold those gains, however, and slumped over the rest of the month.

Image source: Getty Images.

What’s next for SoundHound?

SoundHound has gotten a lot of attention from investors for its exposure to AI, but after surging last year, the stock seems to have gotten ahead of itself.

SoundHound isn’t profitable, and it trades at a price-to-sales ratio of 72. The company is still small, with this year’s revenue expected to be less than $100 million.

The AI stock is growing quickly, but it has a lot to prove as a business. If it emerges as the leader in voice AI, it could be huge, but it seems likely to run into competition from big tech companies if it continues to grow.

Jeremy Bowman has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Cerence. The Motley Fool has a disclosure policy.