Palantir (PLTR 0.47%) has been one of 2024’s best-performing stocks. As of the time of writing, it has risen an astounding 340%, meaning the stock has more than quadrupled in 2024. That’s an impressive performance, but anyone who doesn’t own the stock is wondering if there’s more upside to be had with Palantir.

With 2025 right around the corner, can Palantir repeat its 2024 performance next year?

Palantir’s AI software is seeing huge growth in the U.S.

With returns like that, you might guess that Palantir is somehow involved with artificial intelligence (AI), and you’d be right. Palantir’s software gives those with decision-making authority all of the information they need to make the most informed choice possible. At first, this software was exclusively used by the government. Then, Palantir expanded its reach to the commercial sector, where it also saw strong demand.

However, the biggest rise in demand occurred recently with its Artificial Intelligence Platform (AIP). AIP allows AI to be integrated into workflows rather than be a tool on the side. It also allows data to be maintained within the platform, so third-party generative AI models don’t have access to potentially sensitive information.

Palantir saw demand for its software explode in 2024, and management is extremely bullish on its future. CEO Alex Karp summarized Q3 in one sentence: “We absolutely eviscerated this quarter, driven by unrelenting AI demand that won’t slow down.”

In the third quarter, Palantir saw revenue rise 30% year over year to $726 million. However, the U.S. saw outsized demand compared to its international counterparts, as U.S. commercial revenue rose 54% year over year to $179 million, and U.S. government revenue rose 40% year over year to $320 million. Clearly, AI has been a huge hit in the U.S., but that enthusiasm has yet to spill over to the international community.

Another hallmark of Palantir’s AI business is that it’s actually profitable. In Q3, it posted a second consecutive quarter with a 20% profit margin. This proves that a software company doesn’t need to be growth at all costs — growth and financial responsibility can go hand in hand.

But that’s the past; what does the future hold?

Palantir’s business and stock have disconnected

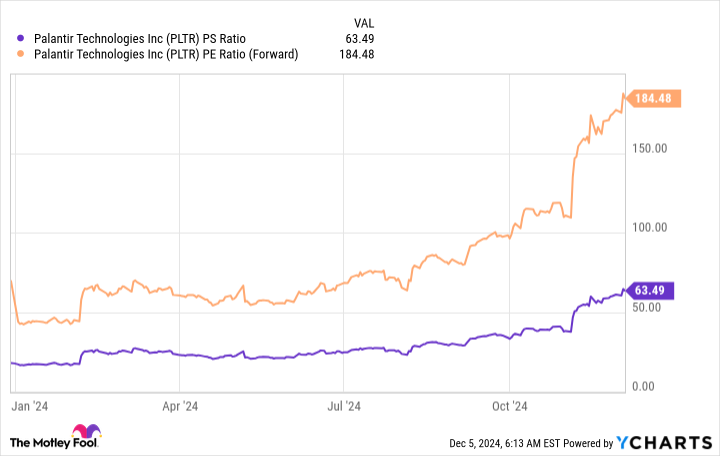

If you’re thinking, “How can Palantir’s stock be up more than 300% when revenue was only up 30%,” you’re not alone. While Palantir’s business looked great, its stock returns are unbelievable. Most of Palantir’s stock returns have come from a mechanism called multiple expansion. Multiple expansion occurs when investors are willing to pay more for a company’s given financials; therefore, its valuation rises. This has happened with Palantir, as the stock now trades for 184 times forward earnings and 63 times sales.

PLTR PS Ratio data by YCharts

If you’re familiar with either valuation metric, then you know how expensive the stock is. Even a forward price-to-earnings (P/E) ratio of 63 would be expensive, yet that’s what it trades at when only sales are accounted for.

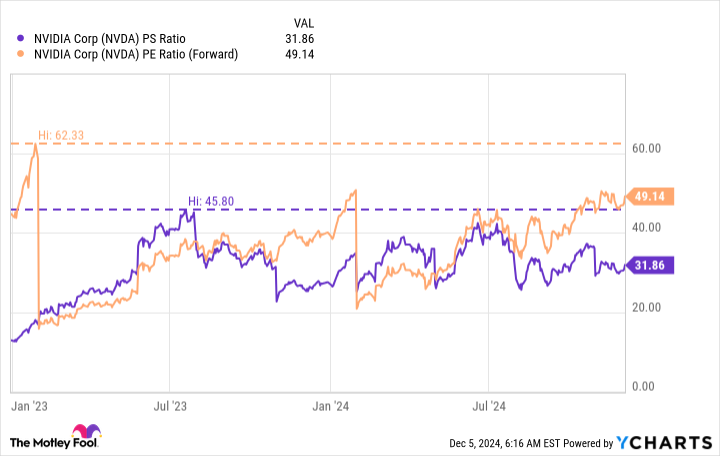

During its two-year run, AI leader Nvidia has never traded for more than 62 times forward earnings or 46 times sales.

NVDA PS Ratio data by YCharts

However, Nvidia also saw its revenue rise 320% from the start of 2023 until now, which justified the higher price tag. Palantir isn’t anywhere close to that growth level, and it has no business being valued as highly as it is.

Unless Palantir’s growth rate accelerates to a pace where it’s doubling year over year, this stock is ripe for a significant pullback, and investors need to be careful with it.

As a result, I don’t think there’s any way for Palantir to repeat its 2024 performance in 2025. If anything, I’d expect to go backward in 2025, as even if the business does well (which I think it will do), the expectations are far too high to produce any sort of positive stock returns.

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.