High-yield energy stock Devon Energy (DVN 1.53%) has a 15.5% upside over the next 12 months or so. At least it does if you believe analysts at Wells Fargo, who just raised the price target on Devon Energy stock to $59 from $46 previously and upgraded the stock to “overweight” from “equal weight.”

Devon Energy’s improving asset base

One reason for the upgrade is enthusiasm for the company’s capital allocation plan and focus on its core assets in the Delaware Basin (straddling west Texas and New Mexico). Devon Energy is allocating 60% of its $3.3 billion to $3.6 billion capital allocation in 2024 to the Delaware basin.

The analyst believes that Devon’s drilling activity in these assets in early 2024 will improve well efficiency. It’s a view shared by management, as its 2024 plan calls for its investment in drilling in the Delaware Basin to improve well productivity by up to 10%.

As previously discussed, the company has a good track record of expanding production and making extensions and discoveries to its resources.

More than just a high-yield stock

If the analyst is correct, Devon Energy will be an even more attractive stock. The current production rate and free cash flow generation imply a significant return to investors (either by share buybacks or dividends) in 2024. By my calculations and management’s estimates (including returning of 70% of cash flow to investors), Devon Energy could return up to 6.7% of its market cap in share buybacks and dividends this year.

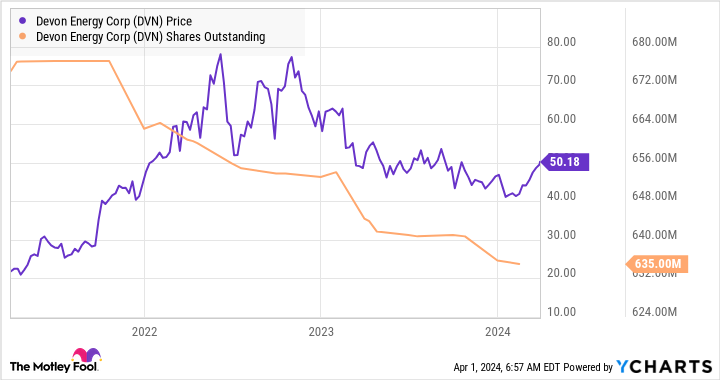

It’s understandable if investors focus on the dividend, but the reality is management is willing to prioritize share buybacks depending on the valuation.

A reduced share count is good news for investors because it increases their share of a claim on future cash flows from the company. In addition, if Devon continues to grow its resources and well productivity, and the price of oil stays at about $80 a barrel, investors can expect significantly more dividends in the future. As such, Devon Energy remains an excellent pick for dividend-focused investors.

Wells Fargo is an advertising partner of The Ascent, a Motley Fool company. Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.