Investors are warming up to Home Depot (HD 0.62%) stock again. The home improvement giant’s shares have rallied over the last several months even though its industry is shrinking. Wall Street is betting that a sales rebound is on the way as interest rates potentially start dropping again in 2024.

The timing of Home Depot’s sales recovery is anyone’s guess, but there are some things investors already know about its momentum as it heads into the new fiscal year. Let’s take a closer look.

1. Traffic is down

Investors should have modest expectations for this business over the short term. Home Depot in mid-November said that comparable-store sales will fall by as much as 4% for the full fiscal 2023 year, in fact. Some of that pressure is coming from temporary issues like price deflation for lumber. But the bigger problem is weak overall demand. You can see evidence of that softness in the chain’s customer traffic, which is down 3% through the first three quarters of 2023.

The good news is that Home Depot is outperforming peers like Lowe’s in this key growth metric. That’s mainly because of its market share leadership and its stronger performance with professional contractors. Yet the stock isn’t likely to have a great year if Home Depot can’t show progress at returning to sales and customer traffic growth in 2024.

2. Finances are strong

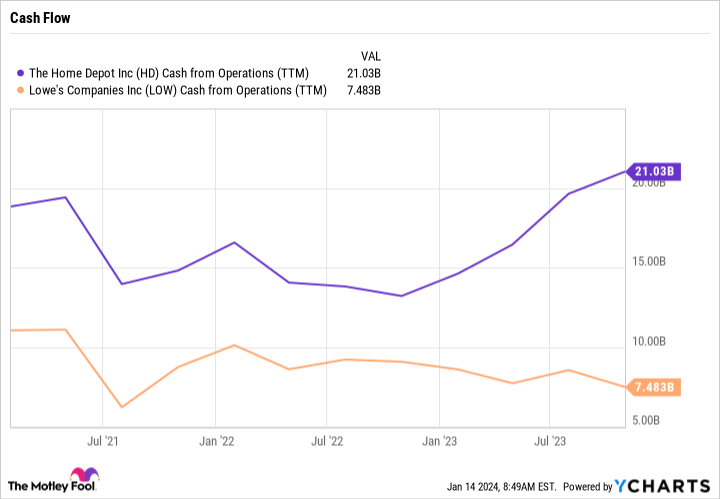

The news is better around Home Depot’s sparkling finances. Profit margin is holding above 14% of sales despite weaker revenue trends, keeping it firmly in the leadership position in the industry. Sure, earnings will likely fall this year. But the retailer is generating ample cash. Operating cash flow over the last nine months jumped to $16 billion from $10 billion despite a slight drop in net income over that time.

HD Cash from Operations (TTM) data by YCharts

These factors mean Home Depot can still afford a decent dividend hike in early 2024. Keep in mind that the company has a more aggressive cash return goal than Lowe’s does. Home Depot aims to return 55% of annual earnings as dividend payments, while Lowe’s target is closer to 35%.

It’s a bit more likely, then, that Home Depot will have to pause or even cut its dividend during a sharp downturn. That happened during the Great Recession, while Lowe’s has kept its dividend streak alive for more than 25 consecutive years.

3. The stock isn’t cheap

You can own Home Depot for a discount compared to its peak valuation in late 2022. Yet its shares are far from cheap. Home Depot is priced at 2.3 times sales compared to Lowe’s 1.4 times sales. That premium also applies on earnings, as the chain is valued at 23 times earnings while Lowe’s can be purchased for 17 times earnings.

You’ll get a lot for that extra price, though. Home Depot pays a more generous dividend and is better positioned to grow through most selling environments. If you’re risk-averse, you might consider watching the retailer stock for now in case volatility on the stock market produces a more attractive price in 2024. But Home Depot is still highly likely to deliver good long-term returns for patient shareholders.

Demitri Kalogeropoulos has positions in Home Depot. The Motley Fool has positions in and recommends Home Depot. The Motley Fool recommends Lowe’s Companies. The Motley Fool has a disclosure policy.