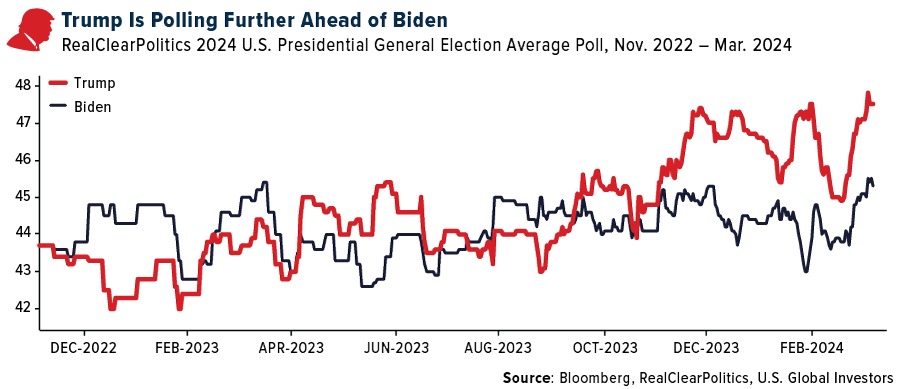

Super Tuesday was, if I may, super obvious. Former President Donald Trump clinched nearly every delegate that was up for grabs last week, forcing his Republican challenger, Nikki Haley, out of the race, which all but guarantees his nomination. Trump’s poll numbers, as aggregated by RealClearPolitics, also show him pulling further ahead of President Joe Biden, whose own favorability remains in the doldrums as the border crisis continues unabated.

Eight months remain until the general election, but I don’t believe it’s too soon for investors to prepare for a potential second Trump term. And let’s be clear: Trump, should he win, would be constitutionally limited to a single additional term, the same as Biden. Since the current administration has reversed a number of Trump-era policies—especially those involving immigration—Trump and lawmakers would need to work fast to implement new legislation and policies before the end of those four years.

Below are three areas for investors to watch in the event of a Trump victory this November.

1. Immigration And Border Security

Immigration is the top issue on most Americans’ minds right now, according to a recent Gallup poll; it’s also arguably the topic most associated with Trump.

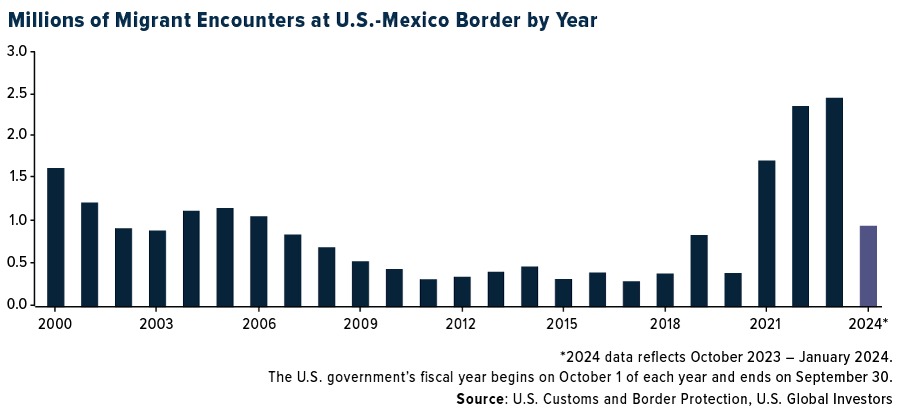

Since Biden took office in 2021, a record number of undocumented migrants have poured into the U.S., alarming families and businesses alike and straining many communities’ infrastructure and resources. So far in fiscal 2024, which began in October 2023, there have been nearly 1 million recorded migrant encounters at the U.S.-Mexico border, exceeding the total amount in most previous years. The U.S. now has a record number of foreign-born people living within its borders at 49.5 million, or 15% of the total population, the Census Bureau reported in October.

Should voters put Trump back in the White House, I expect we’ll see swift action on the immigration front. We’ll likely see the re-implementation of old Trump policies, including “Remain in Mexico,” and as recently as last month, the former president vowed to enact “the largest deportation operation in American history.” A majority of Americans, or 53%, now support building a wall along the U.S.-Mexico border, according to a Monmouth University poll conducted in February.

The bottom line is that people want to feel safe. Safety is a fundamental need on Maslow’s hierarchy of needs, alongside food and water, and Americans are increasingly feeling unsafe.

2. Small-Cap Stocks Ready For A Rebound?

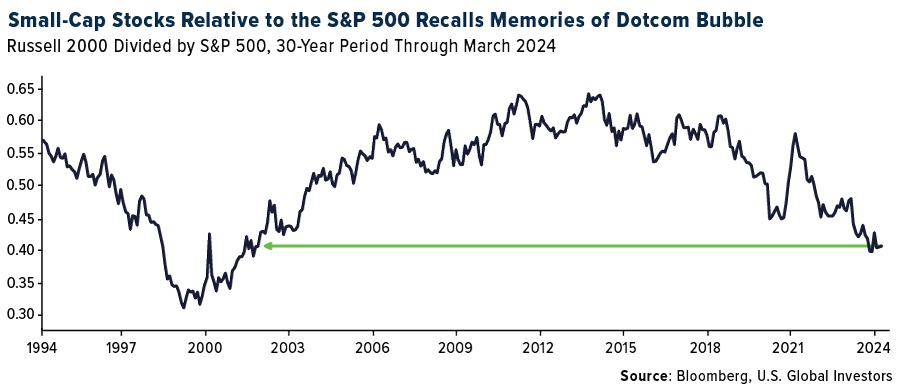

During President Trump’s administration, U.S. small-cap stocks, as measured by the Russell 2000, performed competitively with the S&P 500 as Trump shifted the government’s attention to domestic policy. This—coupled with the 2017 tax reform law, a historic wave of deregulation, low borrowing costs and low inflation—helped smaller, “America first” companies thrive.

Today, the market looks very different. Since the start of Biden’s presidency, the S&P 500 has advanced almost 40%, with the lion’s share of those gains occurring in the last four months as investors, anticipating rate cuts in 2024, scrambled to get exposure to large artificial intelligence (AI) stocks such as Microsoft, Alphabet and NVIDIA. The Russell 2000, by comparison, has remained essentially flat over the same period.

What this means is that small-caps are now at their lowest valuation relative to large-caps since the dotcom bubble more than 20 years ago. A buying opportunity?

Like immigration, I believe a second Trump term would hit the ground running supporting domestic-focused, Mom and Pop-style stores and businesses. During his administration, optimism among small U.S. businesses consistently ran high, with the National Federation of Independent Business’s (NFIB) Small Business Optimism Index hitting an all-time high reading of 108.8 in August 2018. Since that time, the index has fallen more than 17%, registering 89.9 in January 2024.

3. Recommitment To U.S. Energy

The last area I want to touch on is energy, which many voters and investors also associate with Trump.

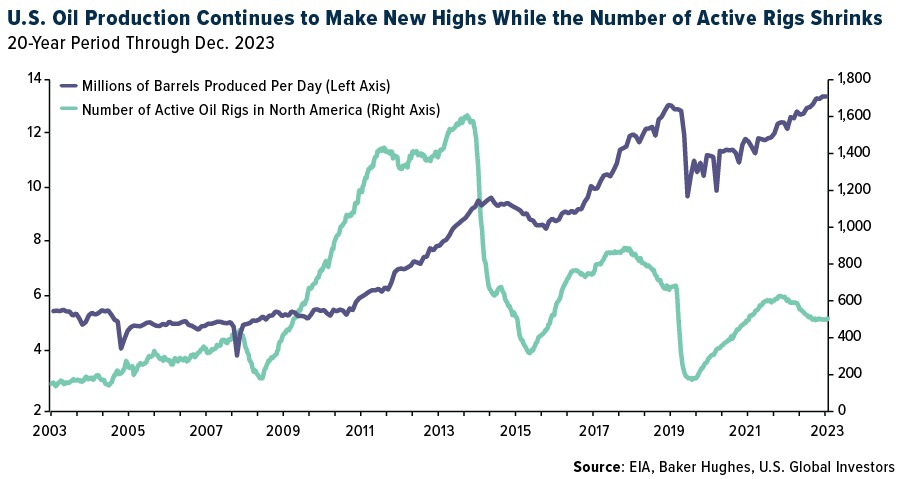

During his administration, gasoline prices remained on the lower end as producers kept the oil flowing. This came to a screeching halt four years ago with the pandemic, but since then, the U.S. has regained its status as the world’s leading supplier of crude. In December 2023, the last month of available data, the U.S. produced a jaw-dropping 13.3 million barrels per day on average. This resulted in a new record amount of oil pumped in a single year, surpassing the previous record set in 2019 when the U.S. produced 4.49 billion barrels.

Interestingly, producers managed to do this even as the number of active oil rigs in North America has continue to trend down. According to Baker Hughes, there were 506 active rigs at the beginning of March 2024, down approximately 70% from the high in October 2014.

So what gives? A new report by the U.S. Energy Information Administration (EIA) asks this very question, finding that new and improved technologies, including hydraulic fracturing (fracking) and horizontal drilling, “have increased well productivity, enabling U.S. producers to extract more crude oil from new wells drilled while maintaining production from legacy wells.”

Producers, in other words, are able to do much more today with far less.

As such, Trump 2.0 would have even less incentive to continue subsidizing renewable energy development. Last year, it was reported that he would “gut” the Inflation Reduction Act (IRA), Biden’s centerpiece climate legislation, chockfull of tax incentives, funding and loans to help the economy transition to clean energy.

—

Originally Posted March 11, 2024 – 3 Key Areas To Watch Ahead Of The November 2024 Election

Past performance does not guarantee future results. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The S&P 500 is widely regarded as the best single gauge of large-cap U.S. equities and serves as the foundation for a wide range of investment products. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. The Russell 2000 Index is comprised of the smallest 2000 companies in the Russell 3000 Index, representing approximately 8% of the Russell 3000 total market capitalization. The National Federation of Independent Business (NFIB) Small Business Optimism Index is a monthly data point that indicates the health of small businesses in the US. The index is a combination of 10 seasonally adjusted components that measure the expectations and outlook of small business owners. The Baker Hughes North American Rotary Rig Count is a weekly census of the number of drilling rigs actively exploring for or developing oil or natural gas in the United States and Canada.

None of U.S. Global Investors Funds held any of the securities mentioned in this article as of 12/31/2023.

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.