The broader weakness in the stock market has weighed on shares of Twilio (TWLO 0.40%) so far this year, with the cloud communications specialist losing more than 4% of its value as of this writing. But the company’s latest quarterly report has injected life into the stock.

Twilio jumped more than 2% after releasing its first-quarter 2025 results on May 1. What’s worth noting is that the stock has recovered 23% in the past month, and its solid quarterly results and guidance indicate that more upside could be in the cards.

Let’s look at the catalysts driving Twilio’s growth and check why this tech stock is capable of heading higher in the second half of the year and beyond.

Image source: Getty Images.

Twilio’s growth is accelerating thanks to artificial intelligence

Twilio reported a 12% year-over-year increase in revenue in Q1 to $1.17 billion. The company’s earnings grew at a much faster pace of 42% from the year-ago period as customers adopted more of its AI-focused cloud communications tools, which led to an increase in spending by existing customers.

This was evident from Twilio’s dollar-based net expansion rate of 107% during the quarter, an improvement of five percentage points from the year-ago period. The dollar-based net expansion rate compares the revenue generated by Twilio’s active customer accounts in a quarter to the revenue generated from those same accounts in the year-ago period.

A reading of more than 100% in this metric suggests that Twilio’s existing customer base is using more of its solutions or has increased the usage of existing solutions. That’s not surprising, as Twilio is now offering AI-focused tools such as Conversation Relay that allow clients to integrate voice-enabled AI solutions into their customer service applications.

Management points out that Conversation Relay can help clients build voice AI agents, as it offers more than 1,000 natural-sounding voices in 40 languages. The good part is that Twilio has started witnessing demand for its voice AI offerings, with one of its customers building a voice AI agent using the company’s tools. Importantly, the size of the voice AI agents market is expected to grow at an annual rate of 35% over the next decade, so there is a good chance that Twilio’s voice AI platform can attract more customers in the long run and drive stronger growth for the company.

Twilio has a massive base of more than 335,000 active customer accounts. This number increased by 7% year over year in the previous quarter and suggests that the company has a tremendous opportunity to cross-sell its AI offerings and witness stronger revenue and earnings growth in the long run.

So, it wasn’t surprising to see Twilio boosting its full-year organic revenue growth guidance to a range of 7.5% to 8.5%, a small jump of 50 basis points at the midpoint. Even better, it is now expecting stronger growth in its non-GAAP operating income to $862.5 million, compared to the earlier estimate of $837.5 million. That would translate into a 38% jump from last year.

Moreover, Twilio’s top-line growth has been accelerating for the past five quarters, and the discussion above suggests that the trend could continue in the future as the adoption of its AI-focused tools improves.

Investors can expect the stock to deliver healthy gains

Twilio carries a 12-month median price target of $130 as per 30 analysts covering the stock, which points toward a 30% jump from current levels. However, there’s a good chance that this cloud stock could do better than that.

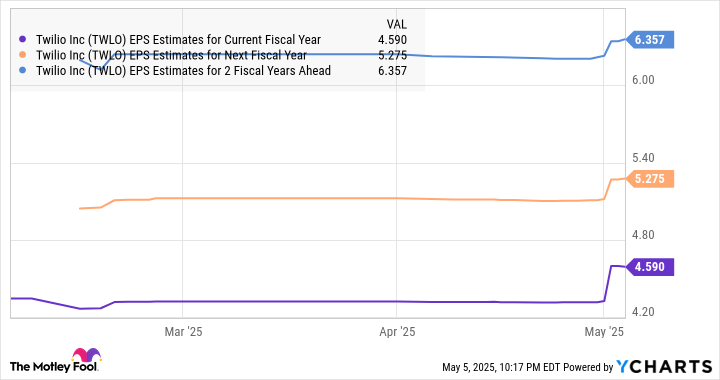

Analysts have bumped up their earnings expectations for 2025, and for the next couple of years. This is evident in the following chart.

TWLO EPS Estimates for Current Fiscal Year data by YCharts.

Assuming Twilio achieves $4.59 per share in earnings in 2025 and trades at 29 times earnings at the end of the year, in line with the tech-laden Nasdaq-100 index’s earnings multiple (using it as a proxy for tech stocks), its stock price could hit $134. That would be a 30% jump from current levels. More upside cannot be ruled out, since Twilio seems to be in a position to further raise its guidance, thanks to the adoption of AI solutions in the cloud communications market.

The chart above also suggests that Twilio’s earnings growth is likely to accelerate over the next couple of years. That makes the stock a no-brainer buy right now, as it is trading at just 23 times forward earnings.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Twilio. The Motley Fool has a disclosure policy.